- Developer

- Api Specification

- Account Updater

- Change Log

- Glossary

- Hpp Background Validation

- Hpp Bulk Payments Features

- Hpp Payment Features

- Hpp Payment Features Applepay

- Hpp Payment Features Googlepay

- Hpp Secure Card Features

- Hpp Subscription Features

- Response Codes And Messages

- Special Fields And Parameters

- Video Tutorials

- Xml 3d Secure

- Xml Account Verification Features

- Xml Payment Features

- Xml Payment Features Applepay

- Xml Payment Features Einvoice

- Xml Payment Features Googlepay

- Xml Secure Card Features

- Xml Subscription Features

- Xml Terminal Features

- Api Specification Ach Jh

- F A Q

- Important Integration Settings

- Integration Docs

- Plugins

- Sample Codes

- Java.xml

- Net Hosted Payments

- Net Hosted Secure Cards Amazon Solution

- Net Xml Payments

- Net Xml Secure Cards

- Net Xml Subscriptions

- Php Hosted Payment With Secure Card Storage

- Php Hosted Payments

- Php Hosted Secure Card Amazon Solution

- Php Hosted Secure Cards

- Php Hosted Subscriptions

- Php Xml Payments

- Php Xml Payments With 3d Secure

- Php Xml Secure Cards

- Php Xml Subscriptions

- Understanding The Integration

- Merchant

- Existing Merchant

- F A Q

- Other Information

- Selfcare System

- Bulk Payments

- Change Logs

- Einvoice

- Introduction

- Pay-by-link

- Reporting

- Secure Cards

- Settings

- Account Updater

- Apple Pay

- Cards

- Custom Fields

- Dynamic Descriptors

- E-mail Alerts

- Enhanced Data Templates

- Pay Pages

- Receipt

- Routing Balancing

- Sms Alerts

- Terminal

- Users Delete User

- Users Existing User

- Users New User

- Users Permissions

- Subscriptions

- Unreferenced Refunds After Online Refund Decline

- Virtual Terminal

- Tips And Hints

- New Merchant

- Partner

- Developer

- Api Specification

- Account Updater

- Change Log

- Glossary

- Hpp Background Validation

- Hpp Bulk Payments Features

- Hpp Payment Features

- Hpp Payment Features Applepay

- Hpp Payment Features Googlepay

- Hpp Secure Card Features

- Hpp Subscription Features

- Response Codes And Messages

- Special Fields And Parameters

- Video Tutorials

- Xml 3d Secure

- Xml Account Verification Features

- Xml Payment Features

- Xml Payment Features Applepay

- Xml Payment Features Einvoice

- Xml Payment Features Googlepay

- Xml Secure Card Features

- Xml Subscription Features

- Xml Terminal Features

- Api Specification Ach Jh

- F A Q

- Important Integration Settings

- Integration Docs

- Plugins

- Sample Codes

- Java.xml

- Net Hosted Payments

- Net Hosted Secure Cards Amazon Solution

- Net Xml Payments

- Net Xml Secure Cards

- Net Xml Subscriptions

- Php Hosted Payment With Secure Card Storage

- Php Hosted Payments

- Php Hosted Secure Card Amazon Solution

- Php Hosted Secure Cards

- Php Hosted Subscriptions

- Php Xml Payments

- Php Xml Payments With 3d Secure

- Php Xml Secure Cards

- Php Xml Subscriptions

- Understanding The Integration

- Merchant

- Existing Merchant

- F A Q

- Other Information

- Selfcare System

- Bulk Payments

- Change Logs

- Einvoice

- Introduction

- Pay-by-link

- Reporting

- Secure Cards

- Settings

- Account Updater

- Apple Pay

- Cards

- Custom Fields

- Dynamic Descriptors

- E-mail Alerts

- Enhanced Data Templates

- Pay Pages

- Receipt

- Routing Balancing

- Sms Alerts

- Terminal

- Users Delete User

- Users Existing User

- Users New User

- Users Permissions

- Subscriptions

- Unreferenced Refunds After Online Refund Decline

- Virtual Terminal

- Tips And Hints

- New Merchant

- Partner

This is an old revision of the document!

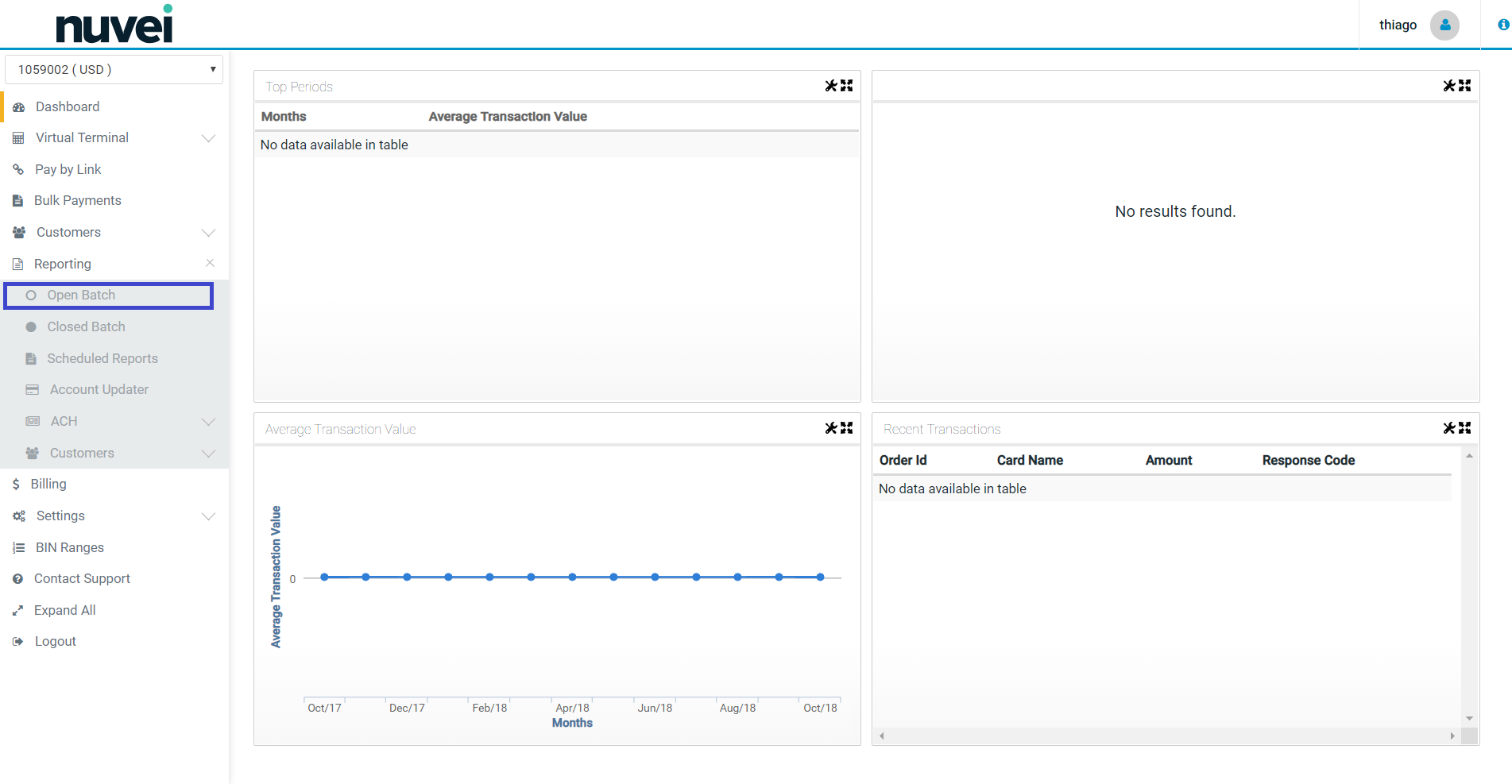

Reporting

Open Batch

The Open Batch report provides Merchants with the ability to:

- I) View the transactions processed and still not settled for a terminal, or all terminals.

- II) Export transactions at open batch to a CSV file.

- III) Mark transactions as “Pending”.

- This will prevent them from being settled until set to “Ready”.

- Transactions cannot be altered from “Ready” to “Pending” after the terminal batch time.

- IV) “Void” transactions before they are settled.

- This will cause them to not be settled and moved to the closed batch at the settlement time.

- A transaction cannot be voided after the terminal batch time.

- V) Mark transactions as “Ready”, instructing Nuvei to settle this transaction.

- VI) View net totals.

- VII) Search transactions in the open batc

- h - by transaction info, card details, custom fields or other options.

- VIII) View transaction details.

- IX) Search for transactions.

- X) Resend the cardholder receipt copies.

- XI) Refund transactions not settled yet.

- XII) Print merchant or cardholder receipts copies.

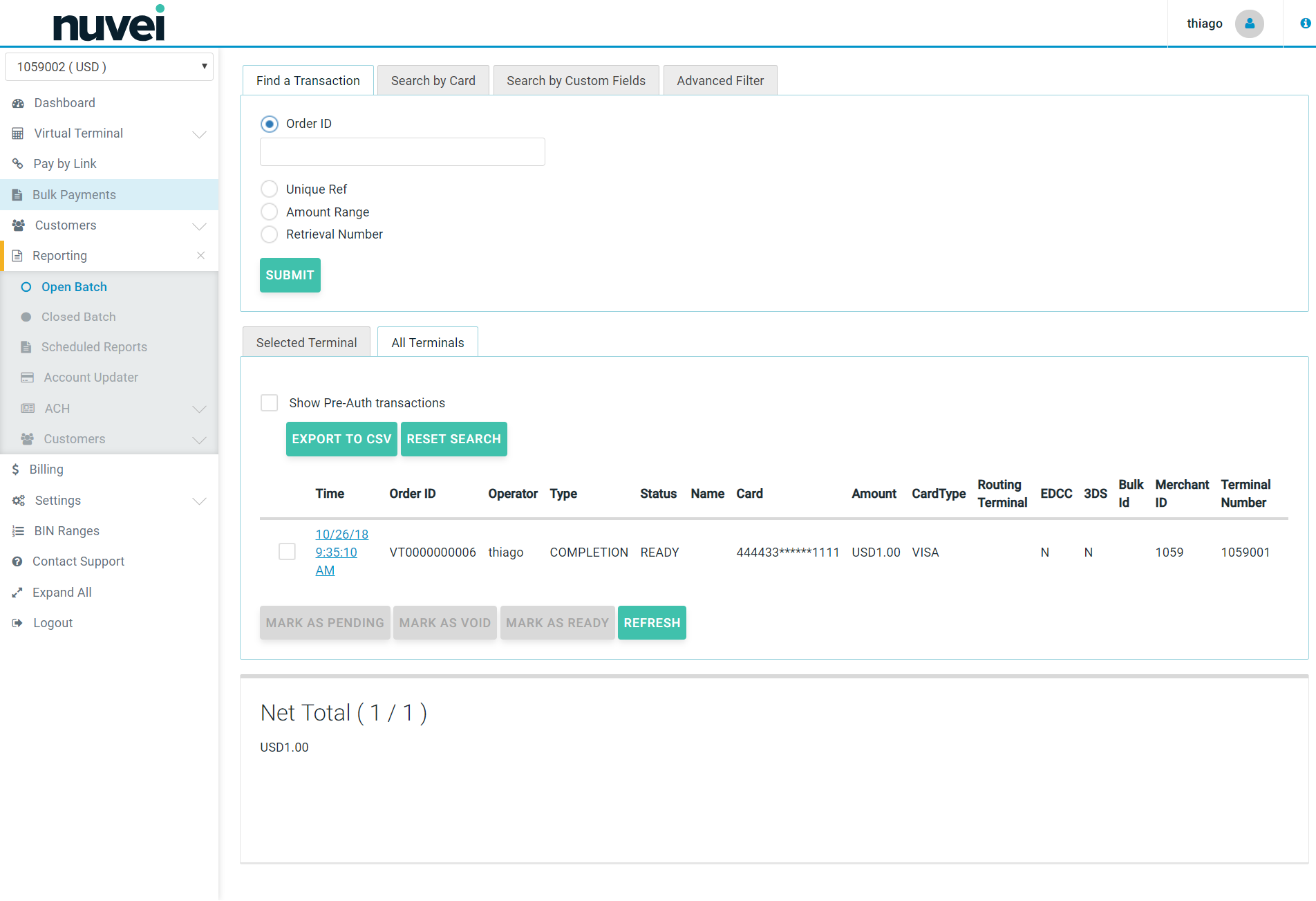

The page size is set to 20 transactions. If the transactions found cannot fit on one page, the list will be apread between several pages and a page navigator will appear above the transactions' list.

In order to mark some transactions as “Pending”, “Void” or “Ready”, you should tick the desired transactions and then click on the relevant button (“Pending”, “Void” or “Ready”).

Only “Ready” transactions will be settled during the next settlement process. “Declined”, “Referral” and “Void” transaction types will all be moved to the “Closed Batch” section during the settlement process.

Please note that “Net Total” is the sum of the ready transactions displayed on the current page only - this value is not calculated for all the transactions related to the terminal.

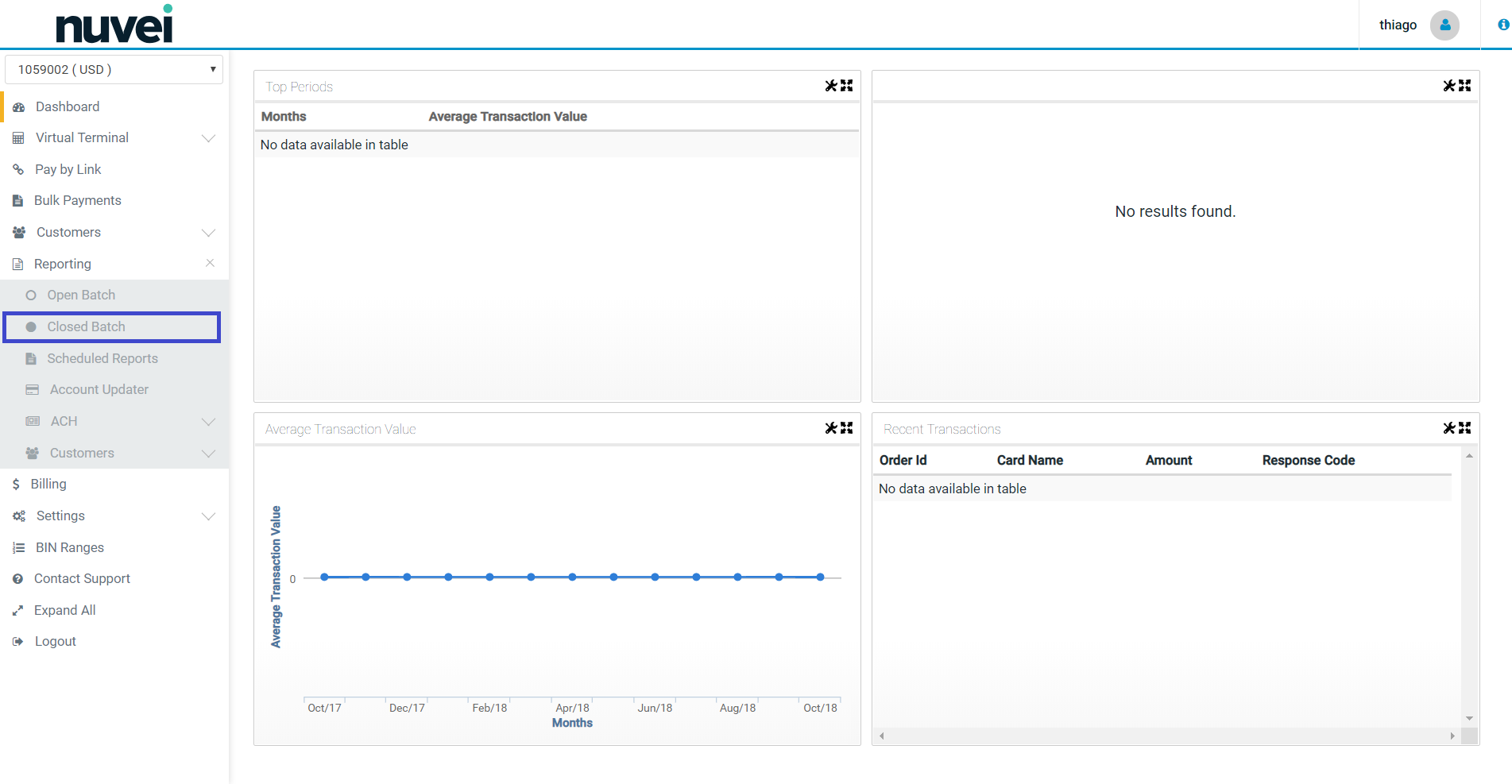

You can access the Open Batch by clicking on the “Reporting” tab:

You can search for open (i.e. unsettled) transactions in the “Find a Transaction” tab by: Order ID (it's a unique transaction number given by the merchant; i.e. order reference number), unique reference (it's a unique transaction number attributed automatically to each transaction by Nuvei system) or by amount range (the range of the transaction value).

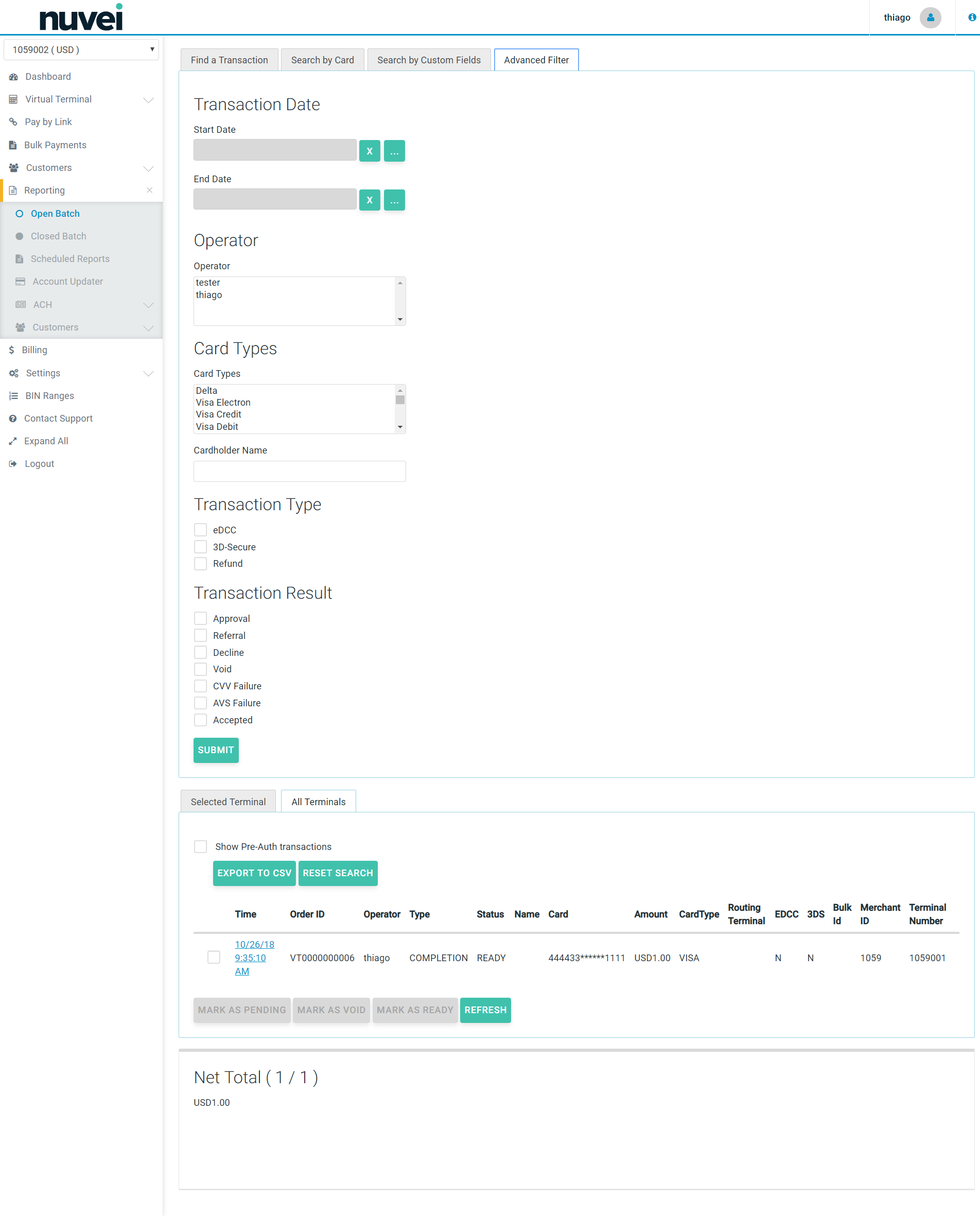

You can also click on the “Advanced Filter” tab, where you will be able to broaden the search criteria by: Transaction Date, Operator, Card Types and Transaction Result (e.g approval, referral, decline, void).

The transaction details include: the settlement time and date, Order ID, Operator (this is the name of the person who processed the credit card details. It can also be be an automatic payment), type of transaction, status (ready, void or refund) name of the cardholder, incomplete card number, amount, card type, and information if an electronic dynamic currency conversion feature was used.

Please see the screenshots below:

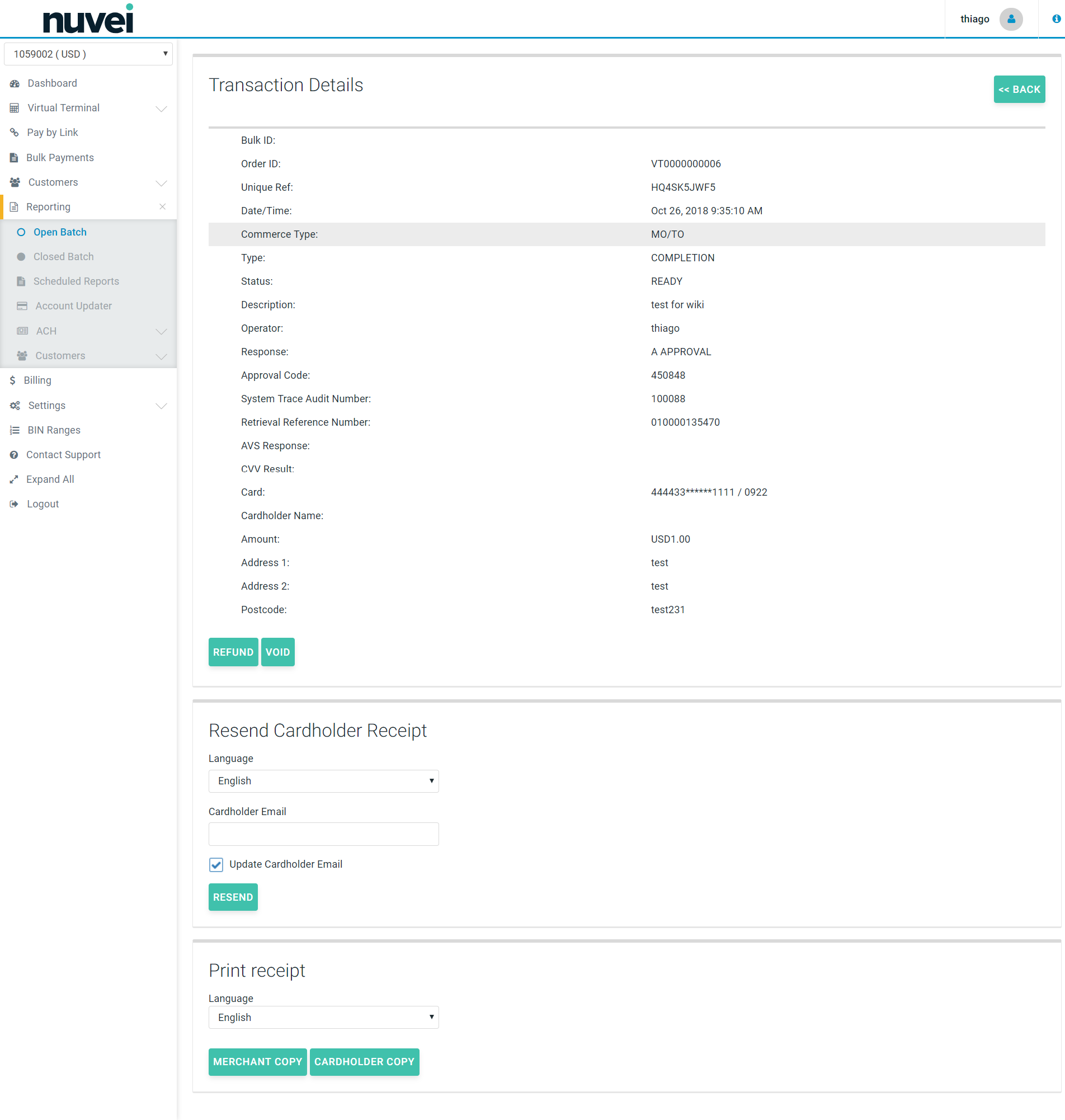

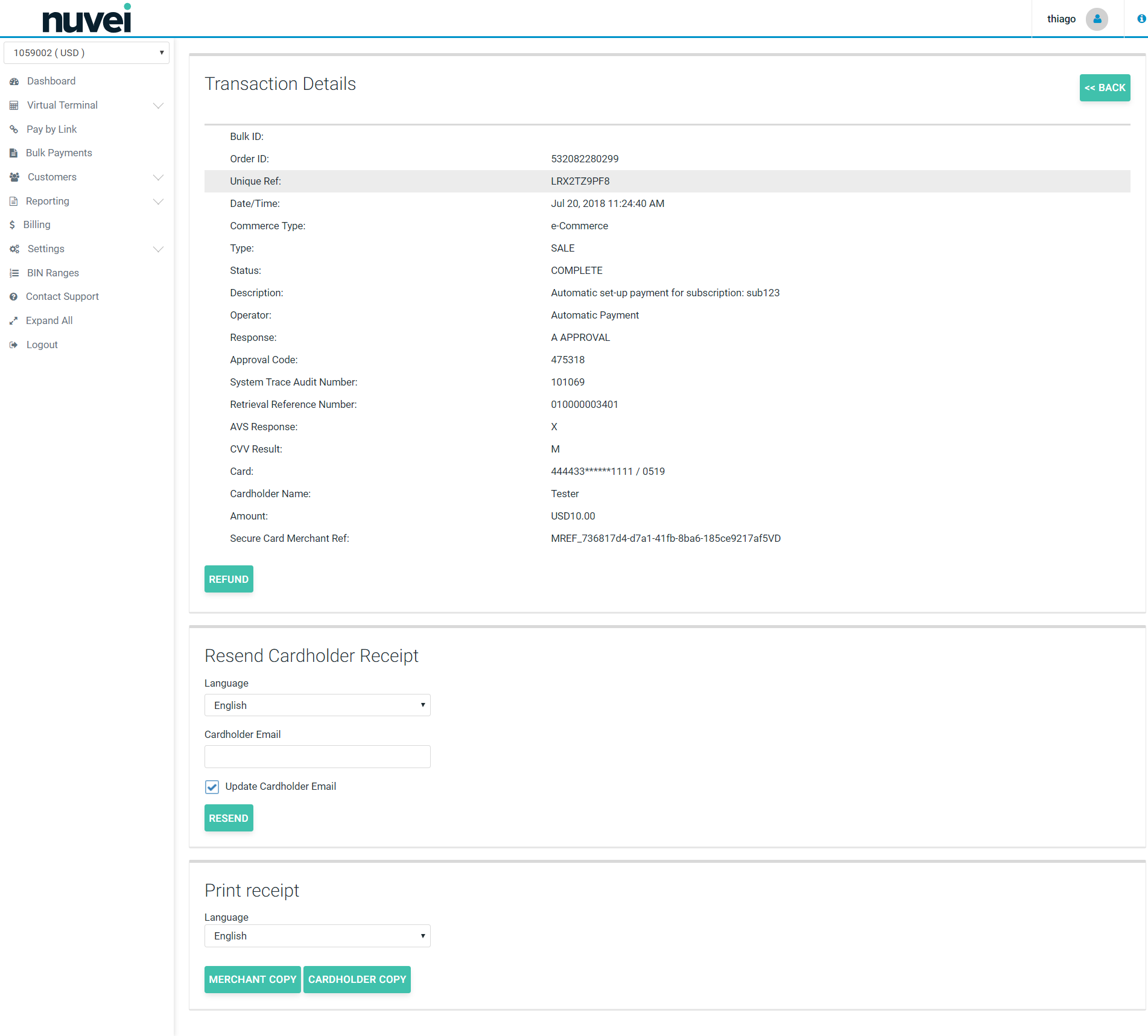

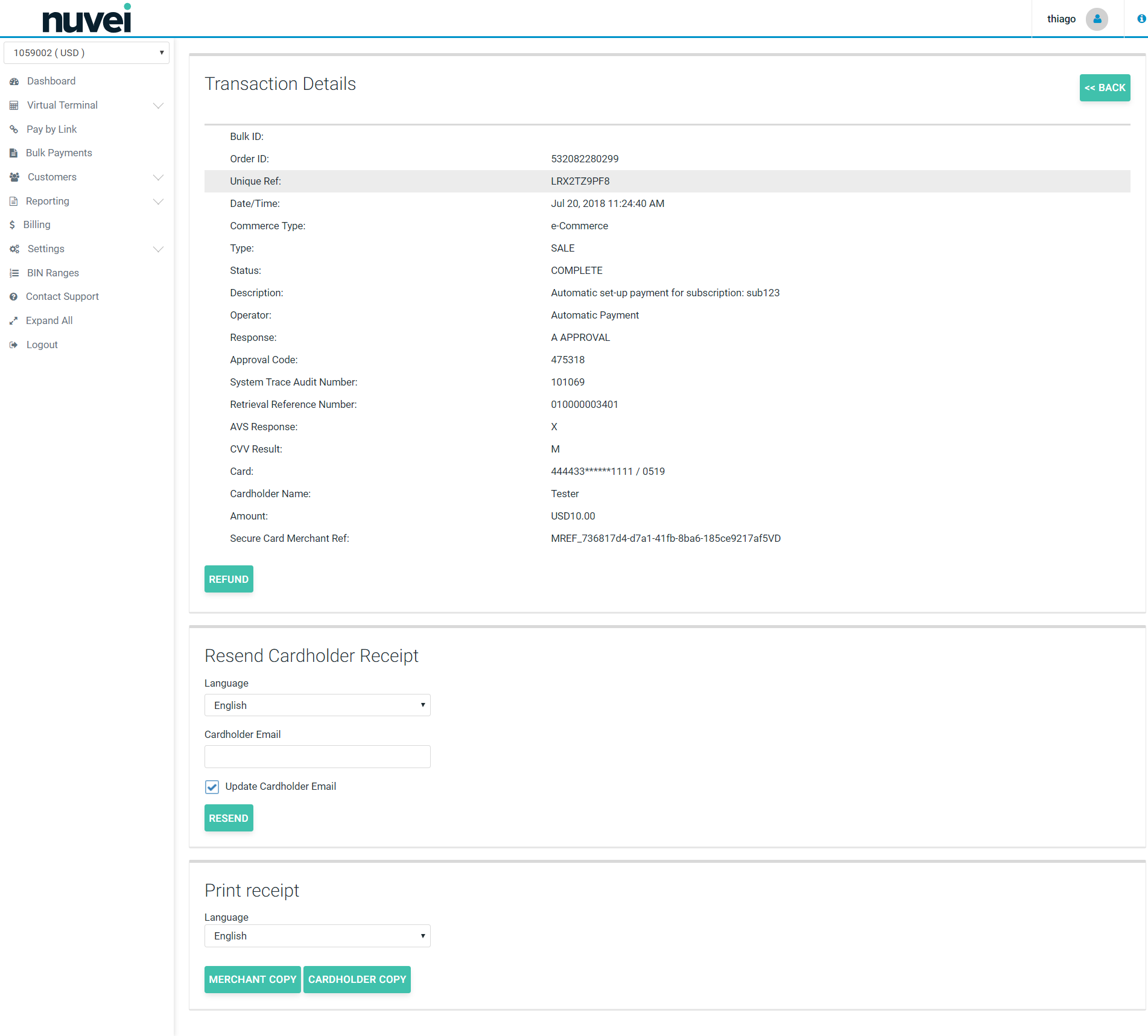

Clicking on the transaction time and date field will display standard transaction details.

You can also void or refund the transaction at this stage by clicking on the “Refund” or “Void” button in the bottom right corner.

If your Terminal is enabled for Secure Cards and Subscriptions, you can also Save Card or Create Subscription from the transaction details page. If you select one of these options the SelfCare System is going to create the Secure Card based on the details of the transaction and if you desire to create a subscription, besides creating the Secure Card, you are going to be redirected to the subscription creation page with a few fields already filled.

It is also possible to print the Merchant Copy or Cardholder Copy of the transaction's receipt, if needed, or Resent Cardholder Receipt by e-mail.

If your Terminal is enabled for Secure Cards and Subscriptions, you can also Save Card or Create Subscription from the transaction details page. If you select one of these options the SelfCare System is going to create the Secure Card based on the details of the transaction and if you desire to create a subscription, besides creating the Secure Card, you are going to be redirected to the subscription creation page with a few fields already filled.

It is also possible to print the Merchant Copy or Cardholder Copy of the transaction's receipt, if needed and depending on the languages configured on the platform, you can also choose in what language the receipt should be.

Additionally, it's also possible to Resend the Cardholder Receipt to the customer's e-mail.

Depending on your Terminal Settings, Another information might be added to the transaction Details: the Fraud Solution Events. These events are related to the Fraud Solution feature in your terminal, and are only applied when the feature is used.

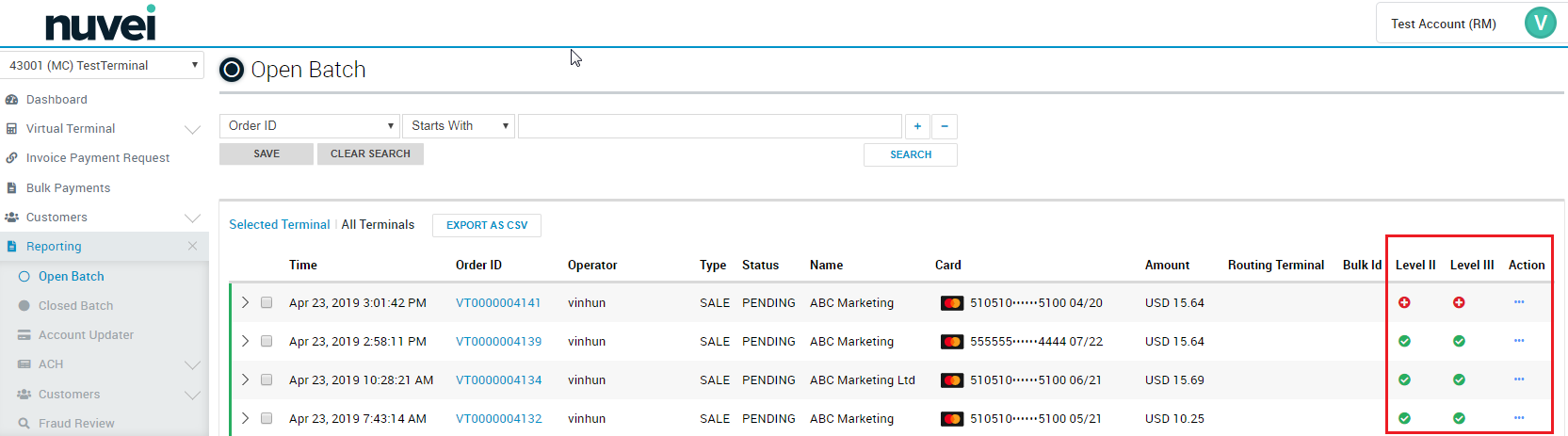

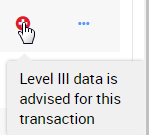

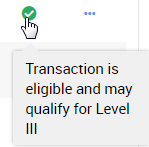

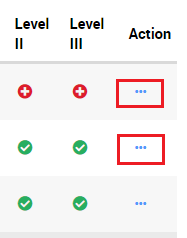

If your terminal is enabled with enhanced data (Level II and III), the Open Batch page will contain columns for Level II and III eligibility by transaction.

Hover over transaction status for additional information.

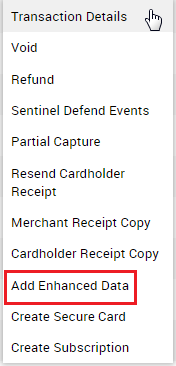

If a transaction has a red or green status, click from the Action Column to add data.

Select Add Enhanced Data to enter information to qualify for Level III.

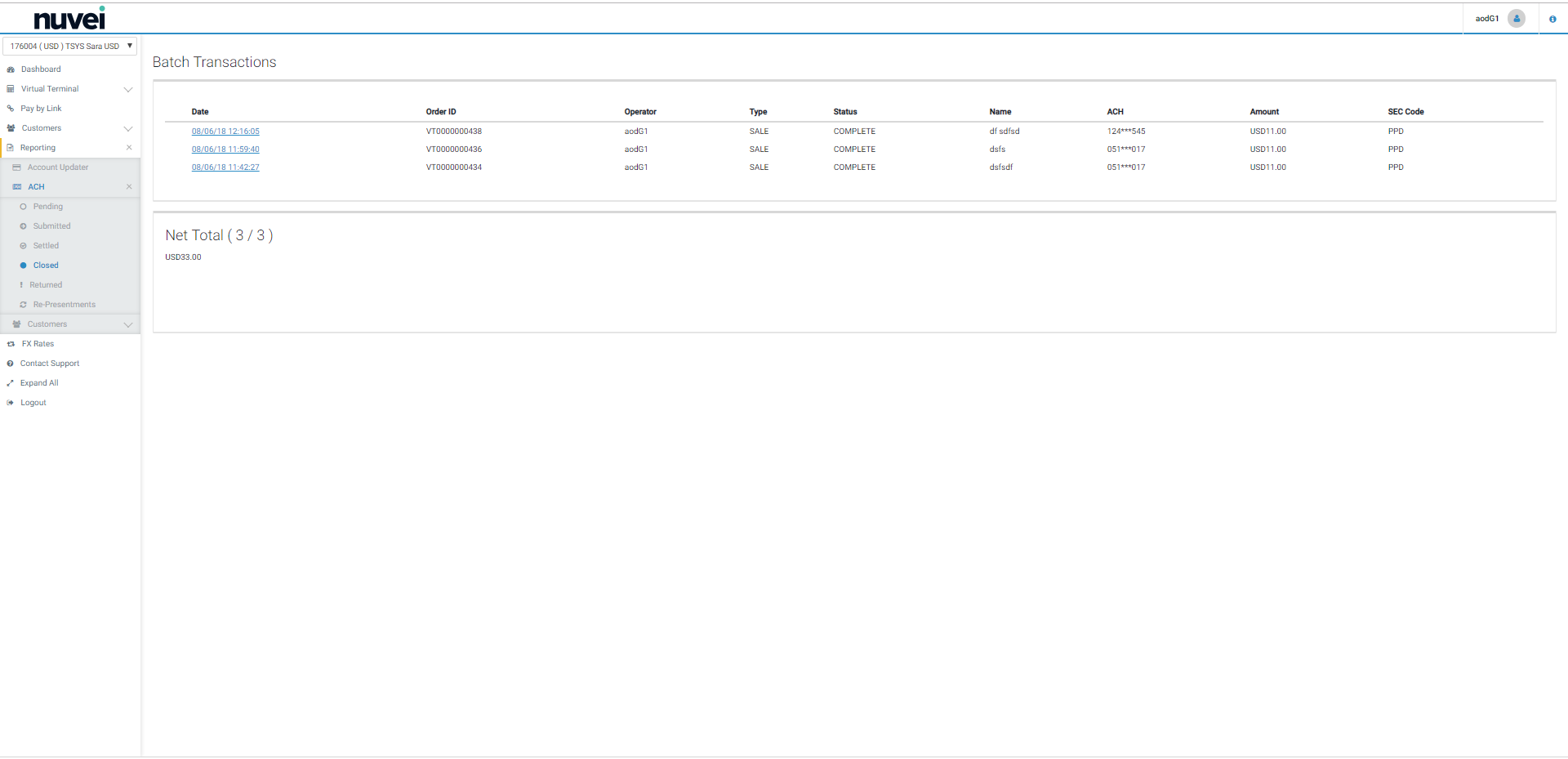

Closed Batch

The Closed Batch report provides Merchants with the ability to:

- I) View closed batches by day, on a terminal or all the merchant's terminals.

- II) View transactions on a closed batch with general details.

- III) Export transactions on a closed batch to a CSV file.

- IV) View net totals.

- V) Search transactions in closed batches - by transaction info, card details, custom fields or other options.

- VI) View transaction details.

- VII) Resend the cardholder receipt copies.

- VIII) Refund older transactions which have already been settled.

- IX) Print merchant or cardholder receipts copies.

You can access the Closed Batch by clicking on the “Reporting” tab:

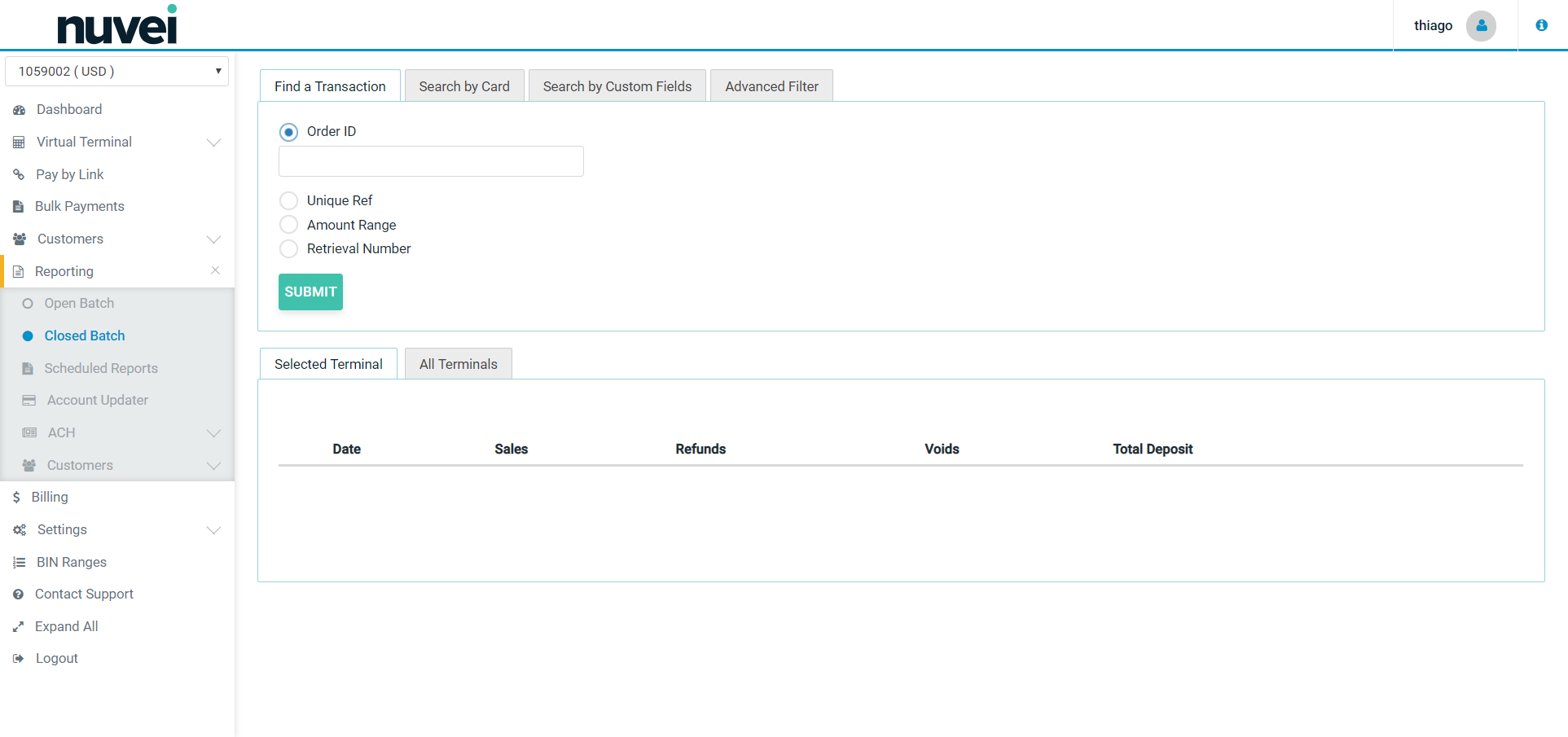

You can search for settled (i.e. closed) transactions in the “Find a Transaction” tab by: Order ID (it's a unique transaction number given by the merchant; i.e. order reference number), unique reference (it's a unique transaction number attributed automatically to each transaction by Nuvei system) or by amount range (the range of the transaction value).

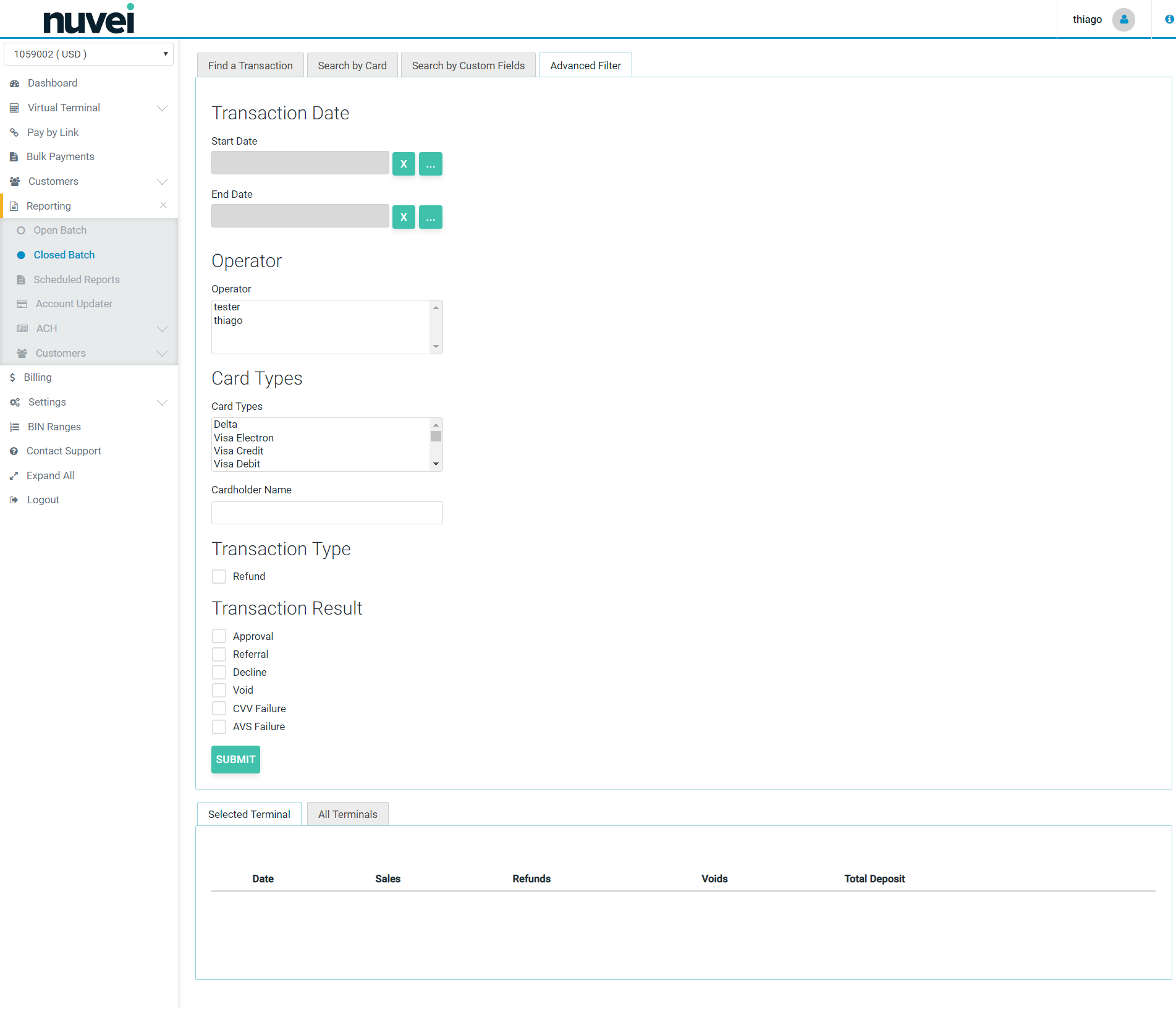

You can also click on the “Advanced Filter” tab, where you will be able to broaden the search criteria by: Transaction Date, Operator, Card Types and Transaction Result (e.g approval, referral, decline, void)

In closed batch you will be able to view all settlements for the terminal. The transactions are grouped by settlement date/time and the batch will show number and value of: sales per batch, refunds, voids as well as total deposits.

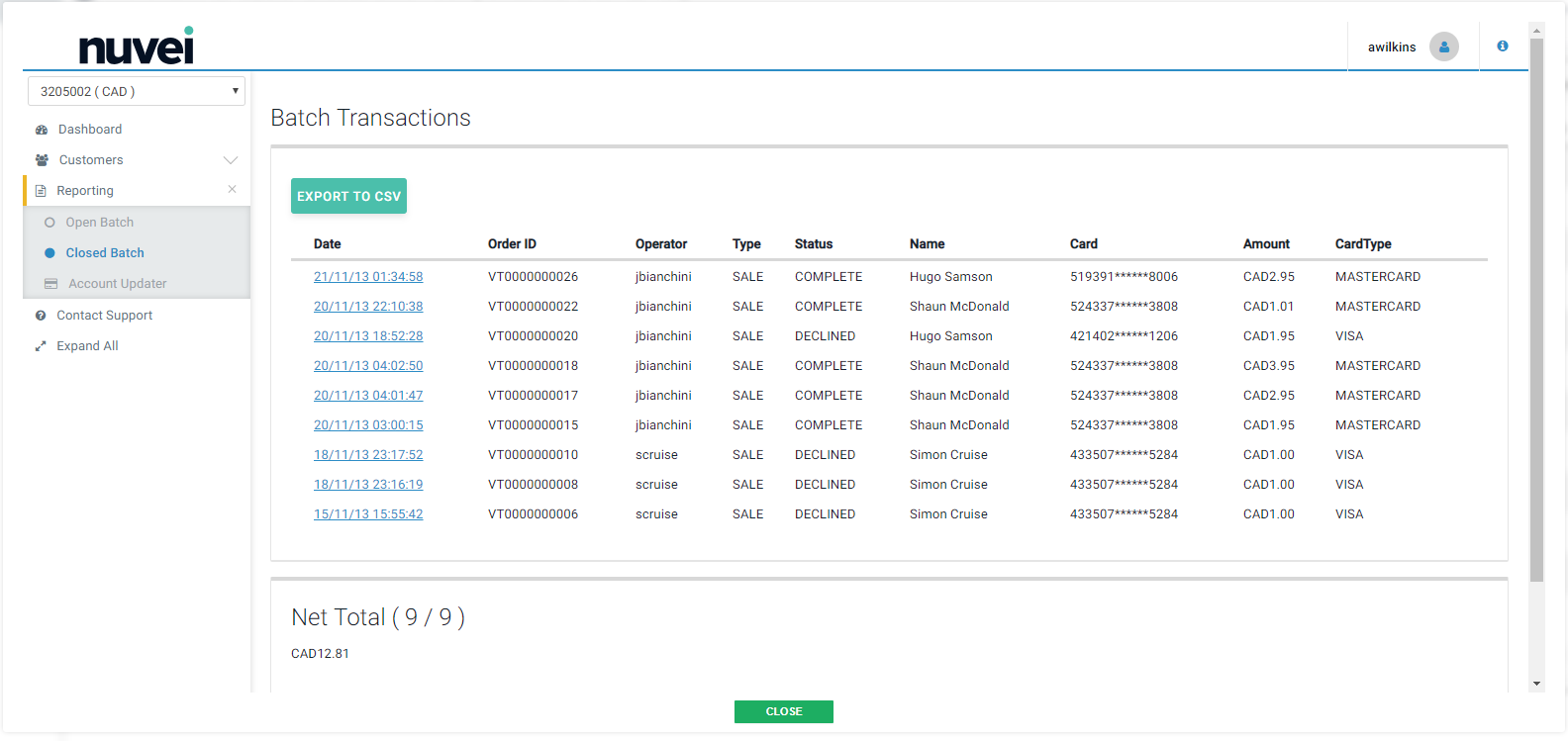

To view the Batch transaction details simply click on the date of the settlement you wish to view. The batch transaction details include the transactions Time and Date, Order ID, Operator (this is the name of the person who processed the credit card details. It can also be an automatic payment), type of transaction, status, name of cardholder, securely masked card number, amount, and card type.

Below the transactions in the batch you will also see Net Total which will be the sum of all complete transactions on the current page.

Click on the transaction date/time field to see the individual transaction details, as per the screenshots below:

The option to print the Merchant Receipt or the Cardholder Receipt is available. You can also resend the receipt to the merchant from here.

It is possible to refund this transaction at this stage, if needed. Click on the “Refund” button in the bottom right corner.

A completed sale transaction can be refunded only by the operator who is granted permission to perform refunds. Refund controls are not displayed if the logged-on user does not have required permissions.

A refund reason should be provided for each refund and refunded amount can be modified, however the refund amount can’t exceed original sale transaction amount. When the refund reason is entered and the amount checked/modified, clicking on the “Refund” button will create a new refund transaction, and this transaction will appear in the terminal Open Transactions list. Refunds can be cancelled at any time up until the Settlement time by marking the transaction as “Void”. The refund confirmation screen will appear if the operation was successful. New refund transactions will be settled during the nearest settlement process if it is marked as “Ready”.

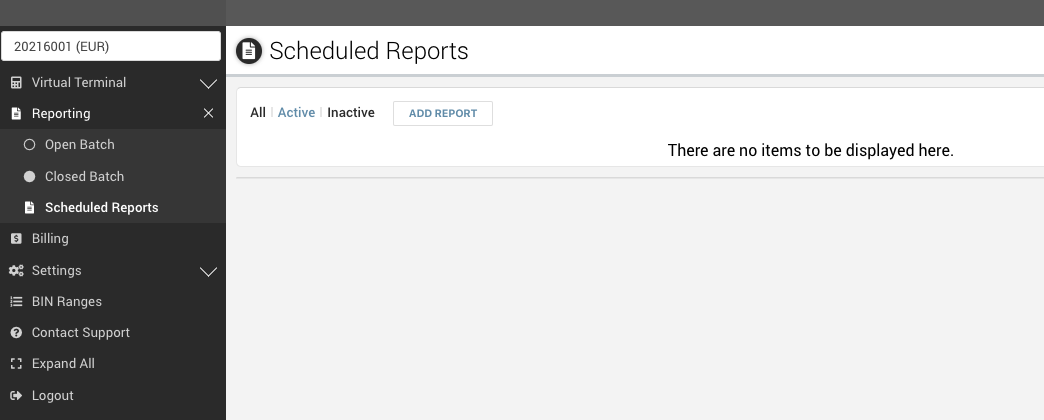

Scheduled Report

Scheduled Reports is a feature designed to facilitate the production of reports from past transactions processed by your terminals. You can create multiple Scheduled Reports to suit your needs and the reports can be delivered by email or FTP. The Scheduled Report feature can be found after logging into the Selfcare system and is located under the Reporting section on the main menu.

If the Scheduled Report is not available in your terminal, please contact the support team to activate the feature.

Creating a Report

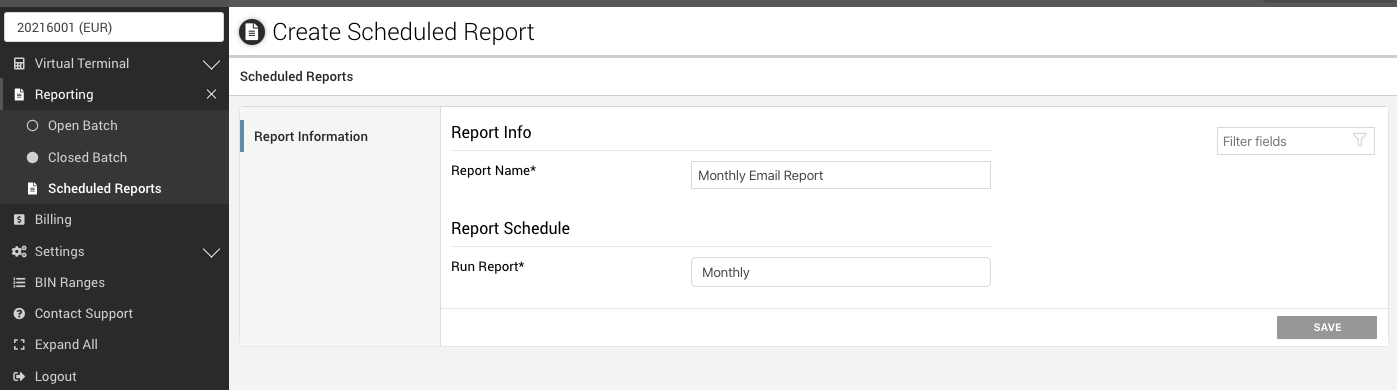

- 1. To create a new report, navigate to the Scheduled Reports section and click Add Report.

- 2. Give the report a name and select how often the report will be run, click Save.

- Please note that if you decided to produce a Once Off report, you will need to set the Start Date and End Date for your report. After the Once Off report is produced and delivered, it will be moved to the Inactive tab in the Schedule Report table.

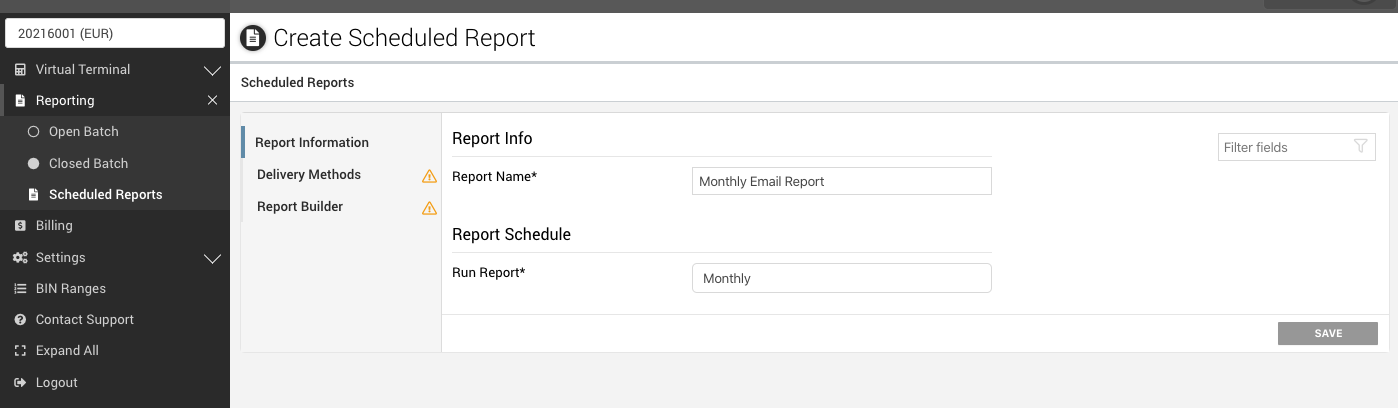

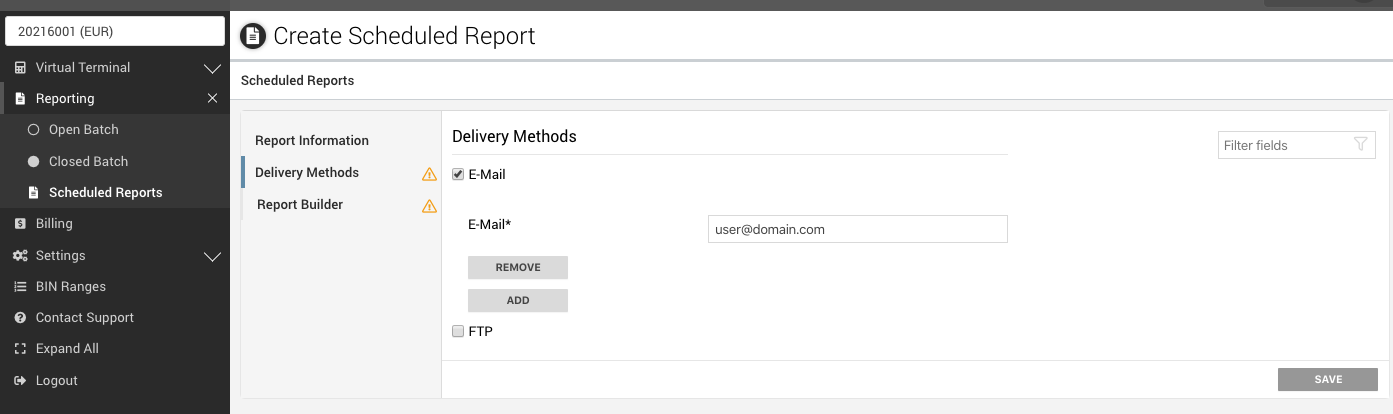

- 3. Select how the Scheduled Report will be delivered and what information will be included in the reports. To proceed to the Delivery Methods tab, click Delivery Methods.

Report Delivery Options

Email Delivery

- 1. To receive your Scheduled Report by email, click E-mail checkbox.

- 2. An input field will be shown, add the email address here.

- *If you want to send to multiple email addresses, click on Add and add a new email address.

- *If you need to remove one of the email addresses, click Remove.

- 3. After adding all the email addresses, click Save.

FTP Delivery

- 1. To receive your Scheduled Report by FTP, click FTP checkbox.

- 2. Fill the form with the details from your FTP server.

- *Currently, the Scheduled Report feature supports accessing FTP servers with username and password.

- 3. Click Save.

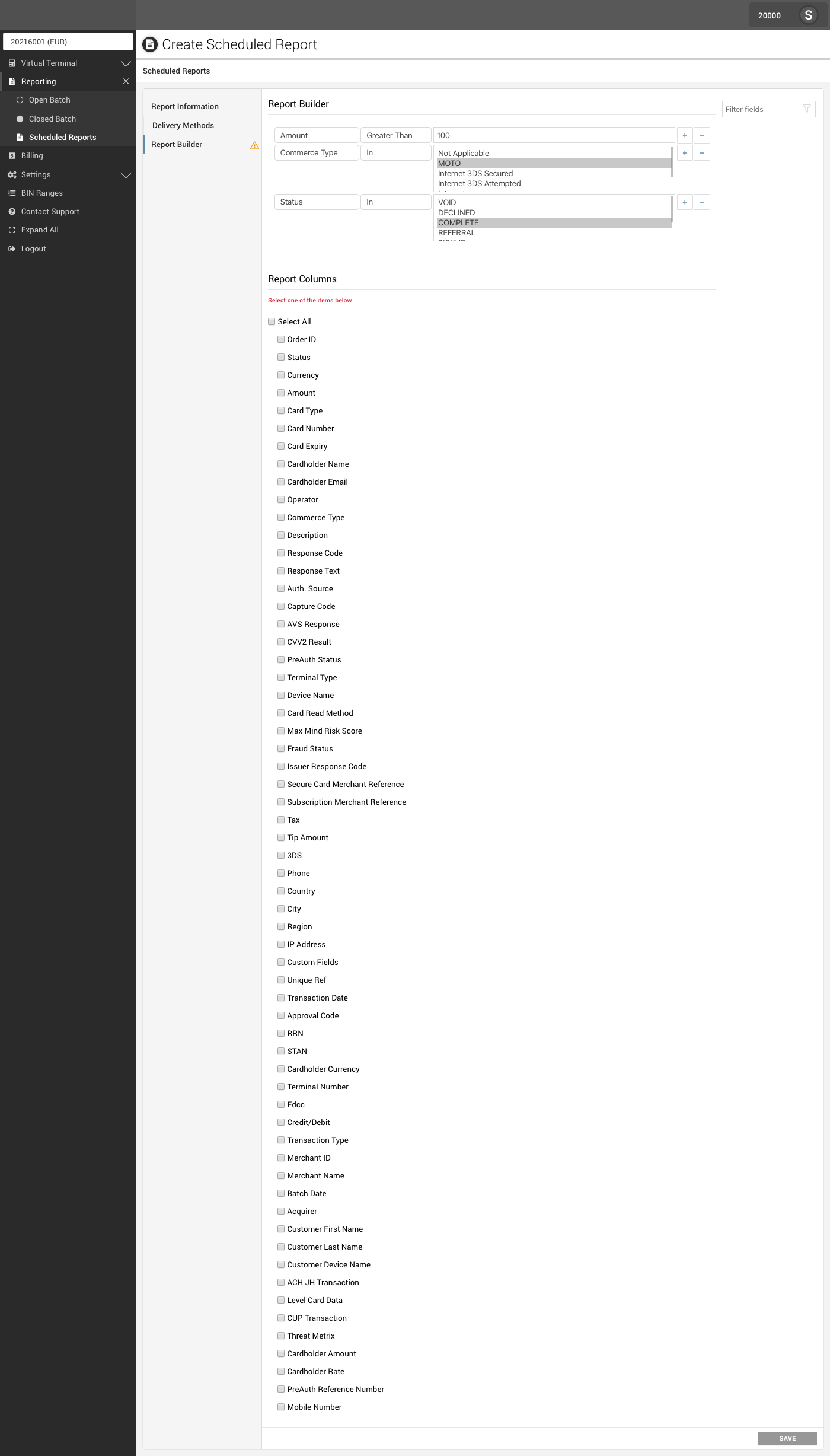

Customizing Scheduled Reports

Now that your delivery methods are set up, we will customize the report with the information for your needs. Click on the Report Builder tab. The section is divided into two parts:

- The first part is the Report Builder filter. This functionality allows you to receive only transactions that are relevant for your report, e.g. only transactions with an amount greater than 100. You can add or remove filters clicking the + or - buttons.

- The second part of this section is the Report Columns. In this area, you can choose what information is going to be available on your report. For example, you want to know the Card Type and Cardholder Email of all your transactions. You can also click on the Select All checkbox to receive all columns available in the report.

After selecting all the columns needed, click Save at the bottom of the screen to proceed.

Account Updater

The Account Updater report enables you to keep track of the updated Secure Cards in your Terminals, making possible:

- I) To track the changes made to the accounts associated to your Secure Cards.

- II) Understand changes which may be causing transaction decline (based on statuses).

- III) Export those “updates” to a CSV file.

- IV) See the amount of changes already updated to your Secure Card.

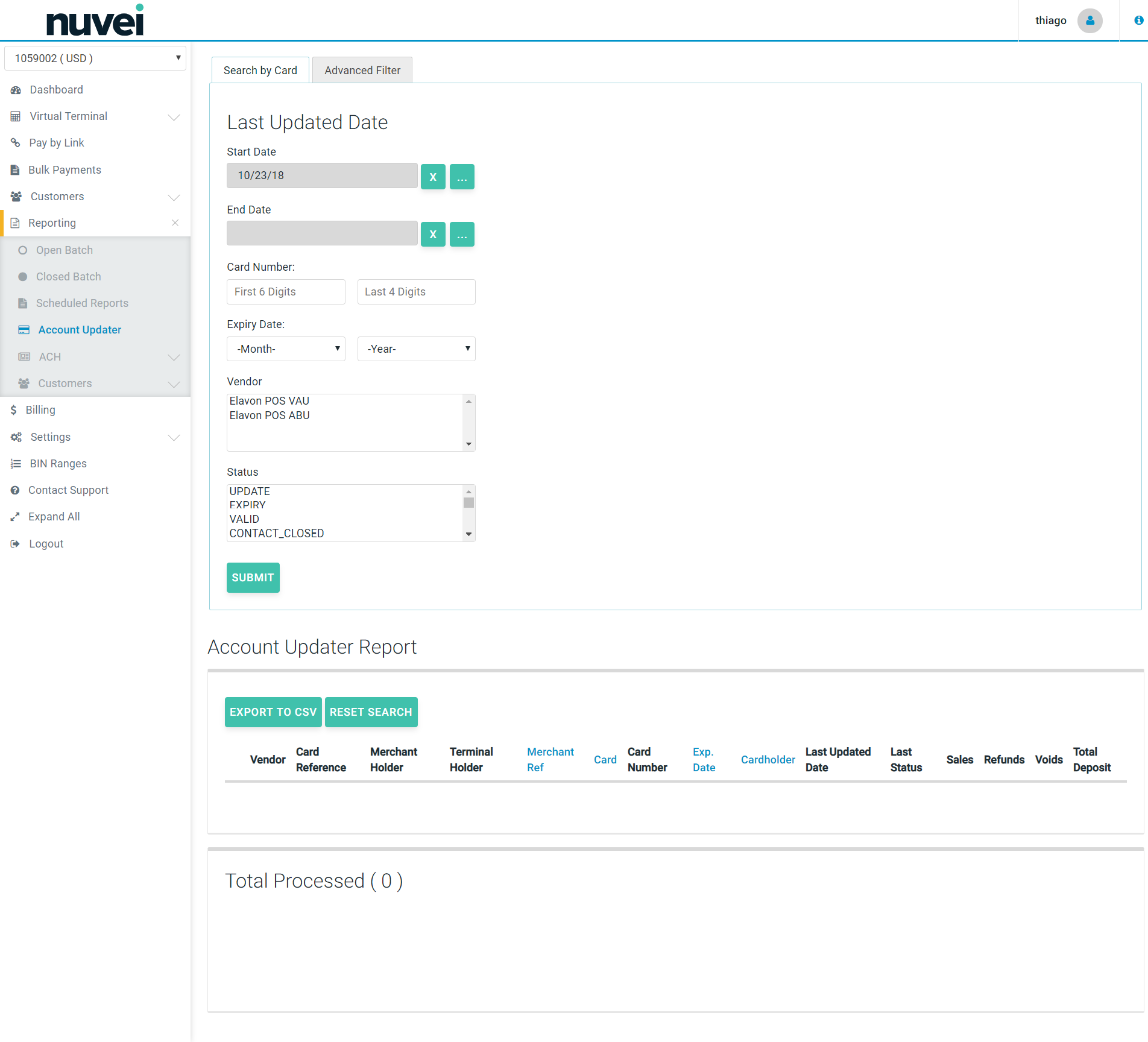

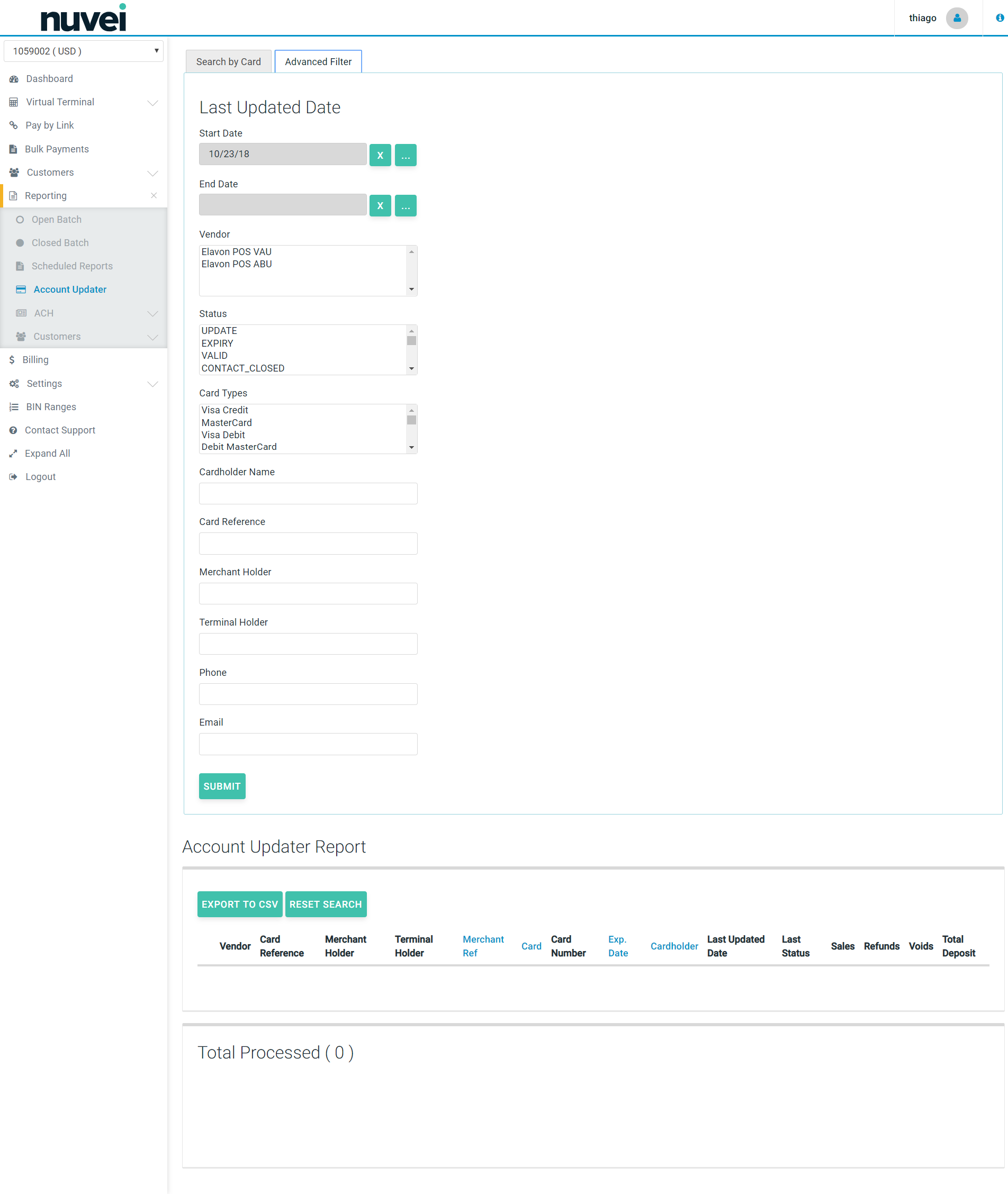

This features allows you to filter your search by the card details, the provider of the Account Update service or the change type, as you can see in the next two images.

Account Updater Report - Search By Card

Account Updater Report - Advanced Filter

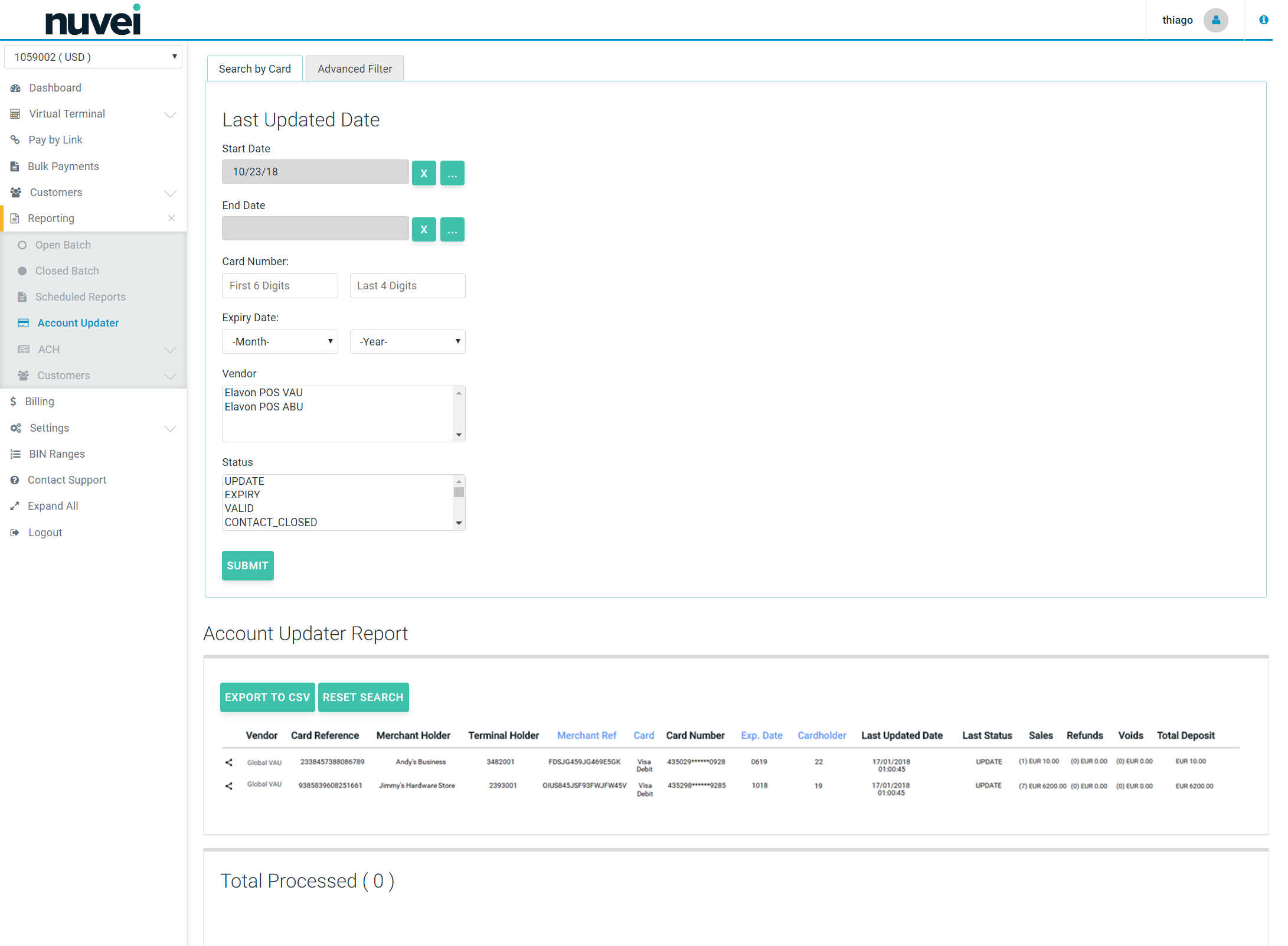

Account Updater Report - Search Result

Following the result of the report, when applied any search, you would be able to see the list of changes already registered by the Account Updater feature, as shown in the next image. Among the data informed, you are going to find the provider or the account update service (vendor), the secure card and card details (card reference, merchant holder, terminal holder, merchant reference, card, masked card number, expiration date, cardholder), the card update details (las update date and status) and payment details (total and volume of sales, refunds, voids and total deposit on that secure card).

It's important to understand that, besides the informative function, the Merchant should understand what each status mean and if they have any impact in its future transactions.

Statuses for Each Registered Update

| NAME | DESCRIPTION |

|---|---|

| VALID | No updates performed. SC details are still valid. |

| UPDATE | Account number or account number, plus expiration date were updated. |

| EXPIRY | Just expiration date was updated. |

| CONTACT_CLOSED | Account was closed (Secure Card invalid). Merchant should contact the cardholder. |

| UNKNOWN | Account number could not be found. SC details are not valid anymore. |

| IN_PROCESS | The updating of this SC details is still in progress. It will change to one of the other statuses as soon as it's finished. |

| CONTACT | Merchant should contact the cardholder. |

| PARTICIPATING | No Match from participating bin issuer (not sure what merchant should do). |

| NON_PARTICIPATING | No Match from non-participating bin issuer (I think this card is not eligible for account updater). |

| UNDEFINED | VAU or ABU returned status_unknown. |

| ER_000101 | Error while updating: Non-numeric Account Number. The SC Details are not valid anymore. |

| ER_000102 | Error while updating: Account Number is not in BIN Range. The SC Details are not valid anymore. |

| ER_000103 | Error while updating: Invalid Expiration Date. The SC Details are not valid anymore. |

| ER_000104 | Error while updating: Merchant Not Registered. The SC Details are not valid anymore. |

| ER_000122 | Error while updating: Un-registered Sub-merchant. The SC Details are not valid anymore. |

| ER_UNSUPPORTED_RESPONSE_CODE | Error while updating: Unsupported response code from the updater service. The SC Details are not valid anymore. In this case, you should contact the Payment Gateway Support team to open an investigation to see what the response code is, and update possible valid responses. |

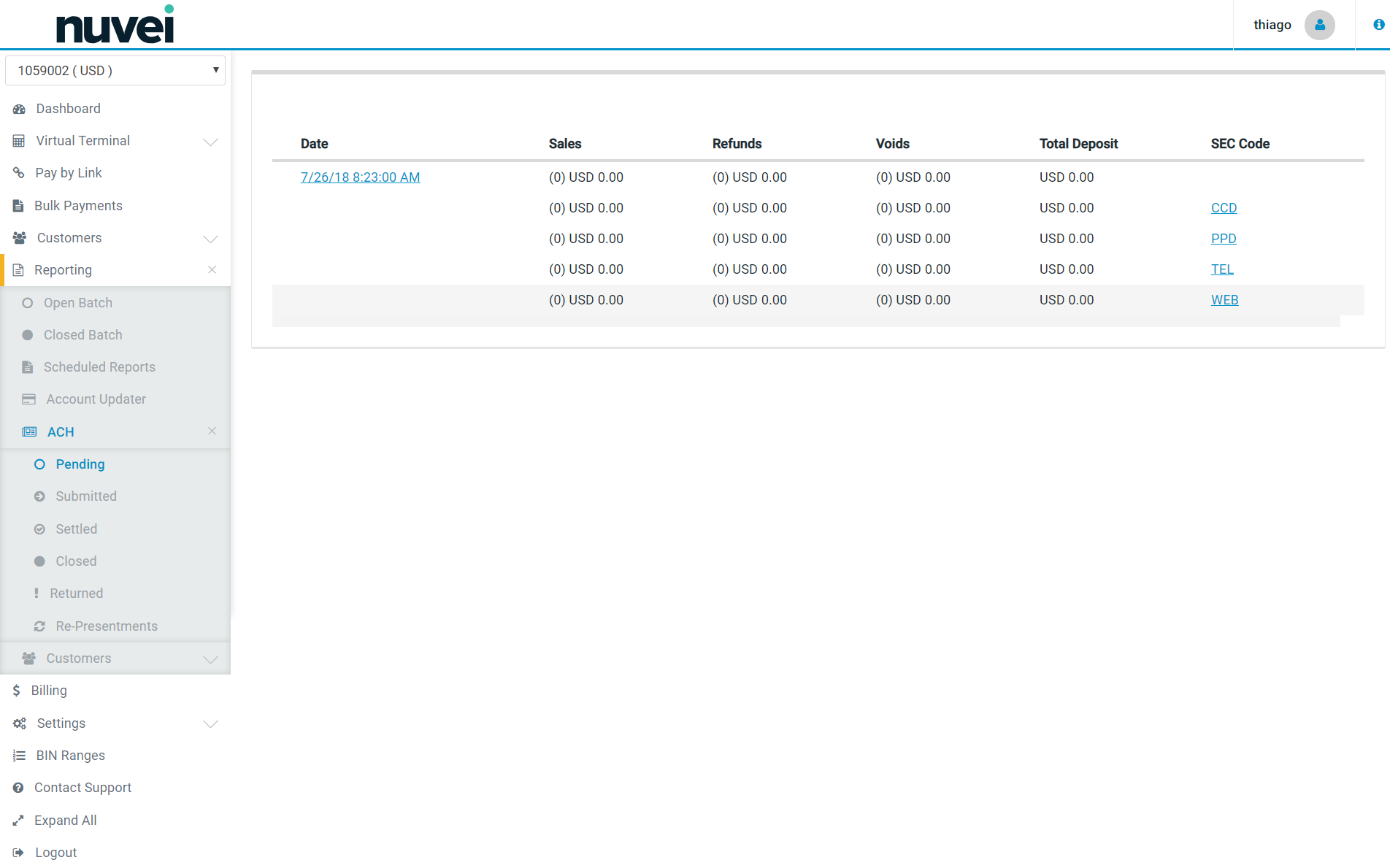

ACH

In case you are using a terminal which can perform ACH Transactions, a separated report option is made available under Reporting > ACH, with those transactions, as you can see at the menu on the following images.

Each report focuses on a specific transaction state, such as:

Pending Transactions

This report presents all the ACH pending transactions for the used terminal:

- I. Grouped by Date.

- II. With a link (click on the date) to show the detailed list of transactions on that date.

- III. Detailed in five summarizing lines for the transactions performed on that date:

- a) The first top line (aligned with the date) represents the sum of the remaining 4 lines (that's why its SEC Code column is always empty).

- b) Each of the four remaining lines represents the total volumes for transactions of each one of the Sec Codes - CCD, PPD, TEL and WEB (refer API Specification - ACH JH to know a little bit more about SEC Codes). Additionally, a link is also provided for each SEC Code to the list of transactions with that code on that date.

- c) Additionally, each line also groups the transactions as Sales, Refunds and Voids by quantity, represented by the value between “()”, followed by its total resulting amount. The Total Deposit totalizes those three types (Sales - Refunds - Voids).

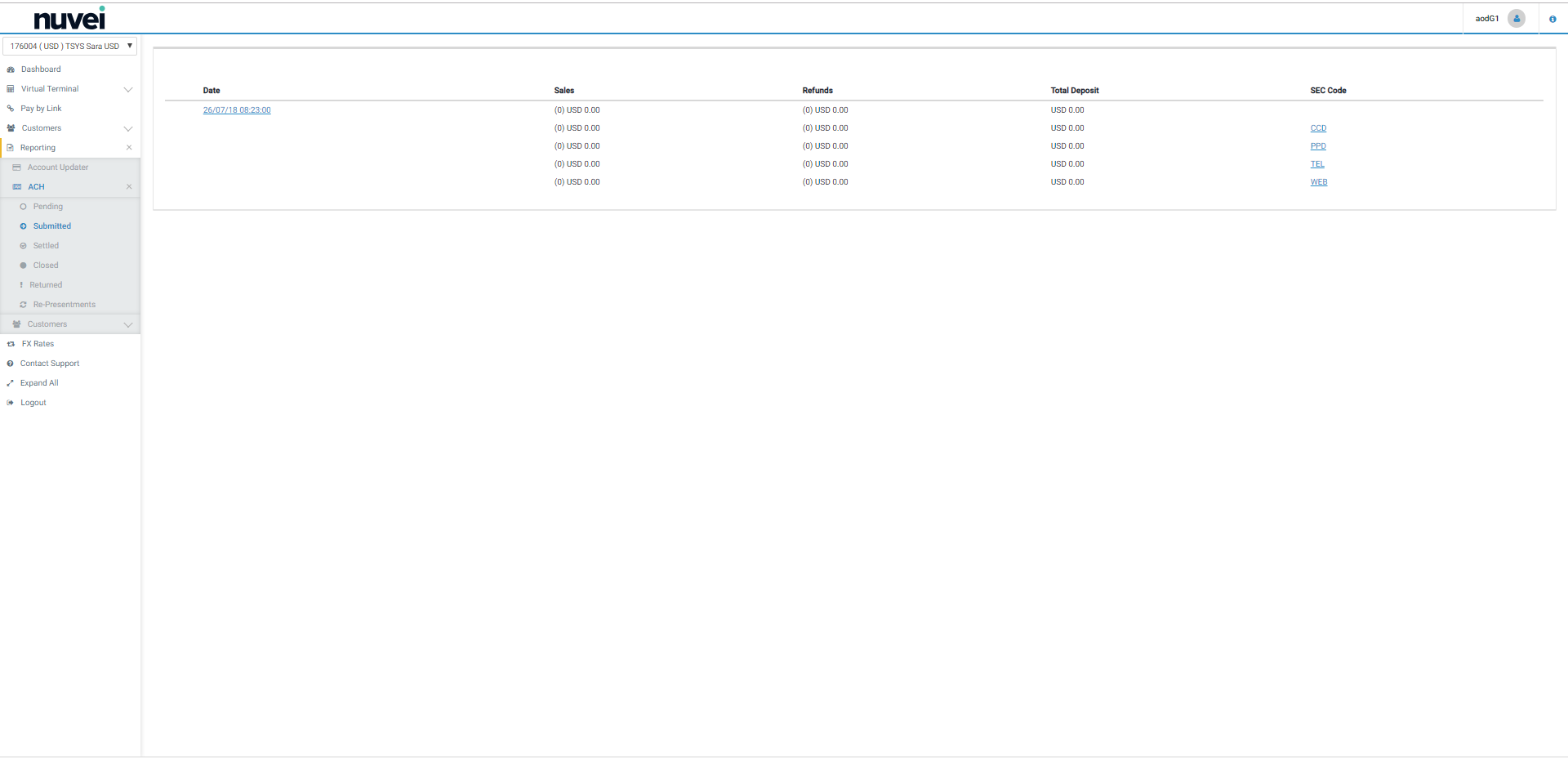

Submitted Transactions

This report presents all the ACH submitted transactions for the used terminal:

- I. Grouped by Date.

- II. With a link (click on the date) to show the detailed list of transactions on that date.

- III. Detailed in five summarizing lines for the transactions performed on that date:

- a) The first top line (aligned with the date) represents the sum of the remaining 4 lines (that's why its SEC Code column is always empty).

- b) Each of the four remaining lines represents the total volumes for transactions of each one of the Sec Codes - CCD, PPD, TEL and WEB (refer API Specification - ACH JH to know a little bit more about SEC Codes). Additionally, a link is also provided for each SEC Code to the list of transactions with that code on that date.

- c) Additionally, each line also groups the transactions as Sales, Refunds and Voids by quantity, represented by the value between “()”, followed by its total resulting amount. The Total Deposit totalizes those three types (Sales - Refunds - Voids).

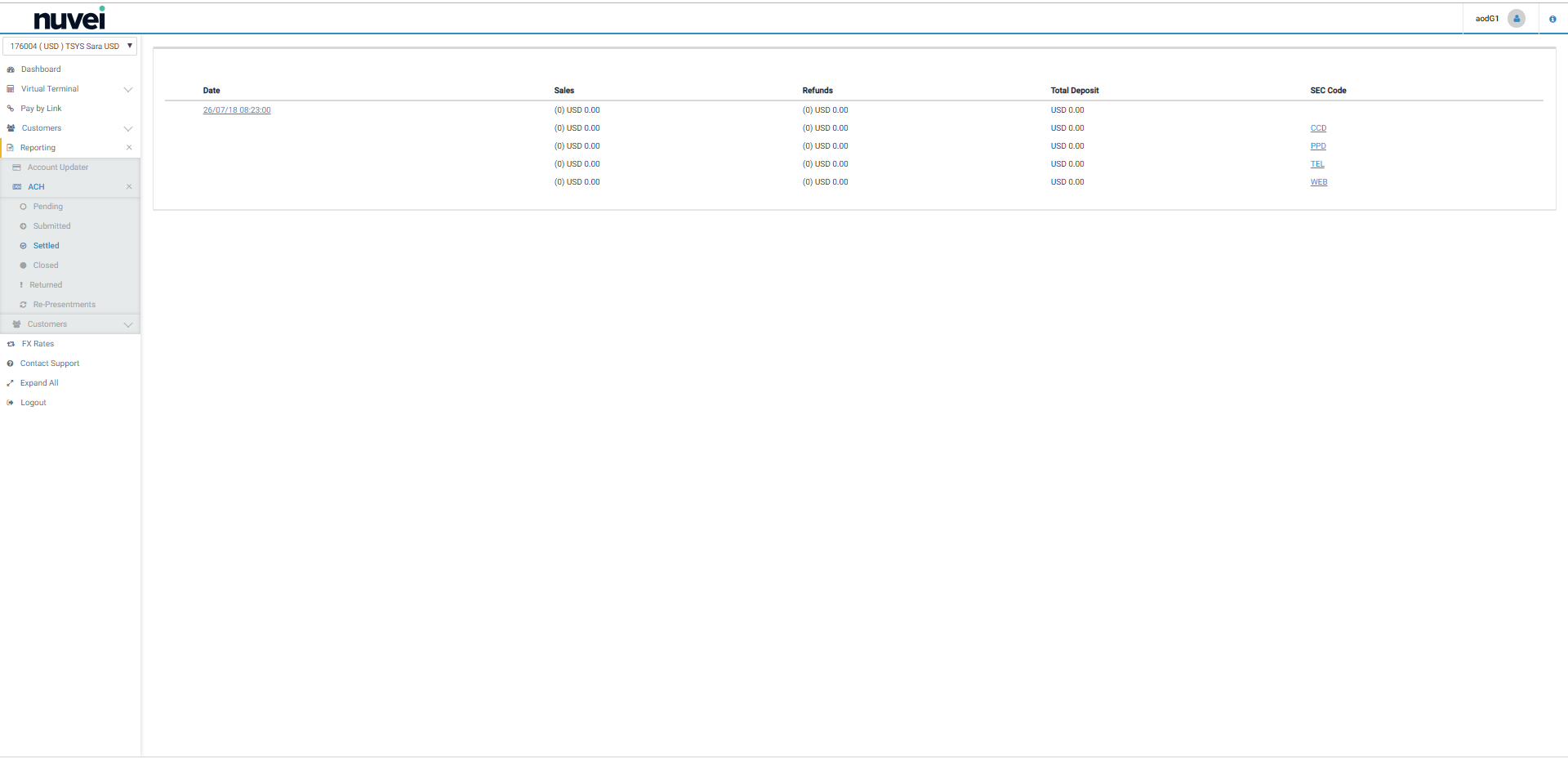

Settled Transactions

This report presents all the ACH settled transactions for the used terminal:

- I. Grouped by Date.

- II. With a link (click on the date) to show the detailed list of transactions on that date.

- III. Detailed in five summarizing lines for the transactions performed on that date:

- a) The first top line (aligned with the date) represents the sum of the remaining 4 lines (that's why its SEC Code column is always empty).

- b) Each of the four remaining lines represents the total volumes for transactions of each one of the Sec Codes - CCD, PPD, TEL and WEB (refer API Specification - ACH JH to know a little bit more about SEC Codes). Additionally, a link is also provided for each SEC Code to the list of transactions with that code on that date.

- c) Additionally, each line also groups the transactions as Sales, Refunds and Voids by quantity, represented by the value between “()”, followed by its total resulting amount. The Total Deposit totalizes those three types (Sales - Refunds - Voids).

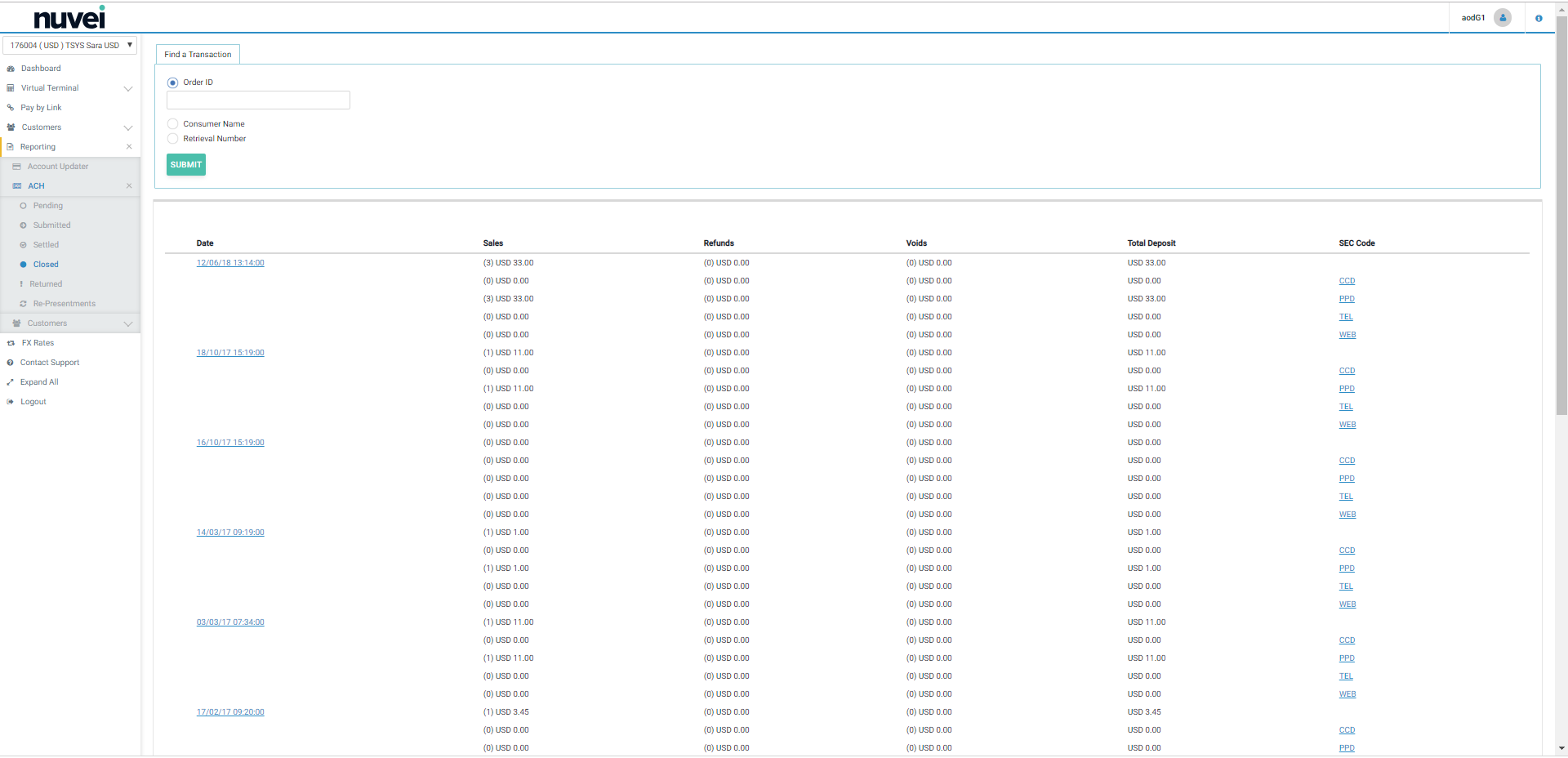

Closed Transactions

This report presents all the ACH closed transactions for the used terminal:

- I. Presenting an option to search the transaction based on a simple filter.

- II. Grouped by Date.

- III. With a link (click on the date) to show the detailed list of transactions on that date.

- IV. Detailed in five summarizing lines for the transactions performed on that date:

- a) The first top line (aligned with the date) represents the sum of the remaining 4 lines (that's why its SEC Code column is always empty).

- b) Each of the four remaining lines represents the total volumes for transactions of each one of the Sec Codes - CCD, PPD, TEL and WEB (refer API Specification - ACH JH to know a little bit more about SEC Codes). Additionally, a link is also provided for each SEC Code to the list of transactions with that code on that date.

- c) Additionally, each line also groups the transactions as Sales, Refunds and Voids by quantity, represented by the value between “()”, followed by its total resulting amount. The Total Deposit totalizes those three types (Sales - Refunds - Voids).

In case you desire to see more details or simple look for a specific transaction from a specific data, whenever you click on a date you are going to be presented to the image below, and if you click on the date link once more, te transaction details are presented.

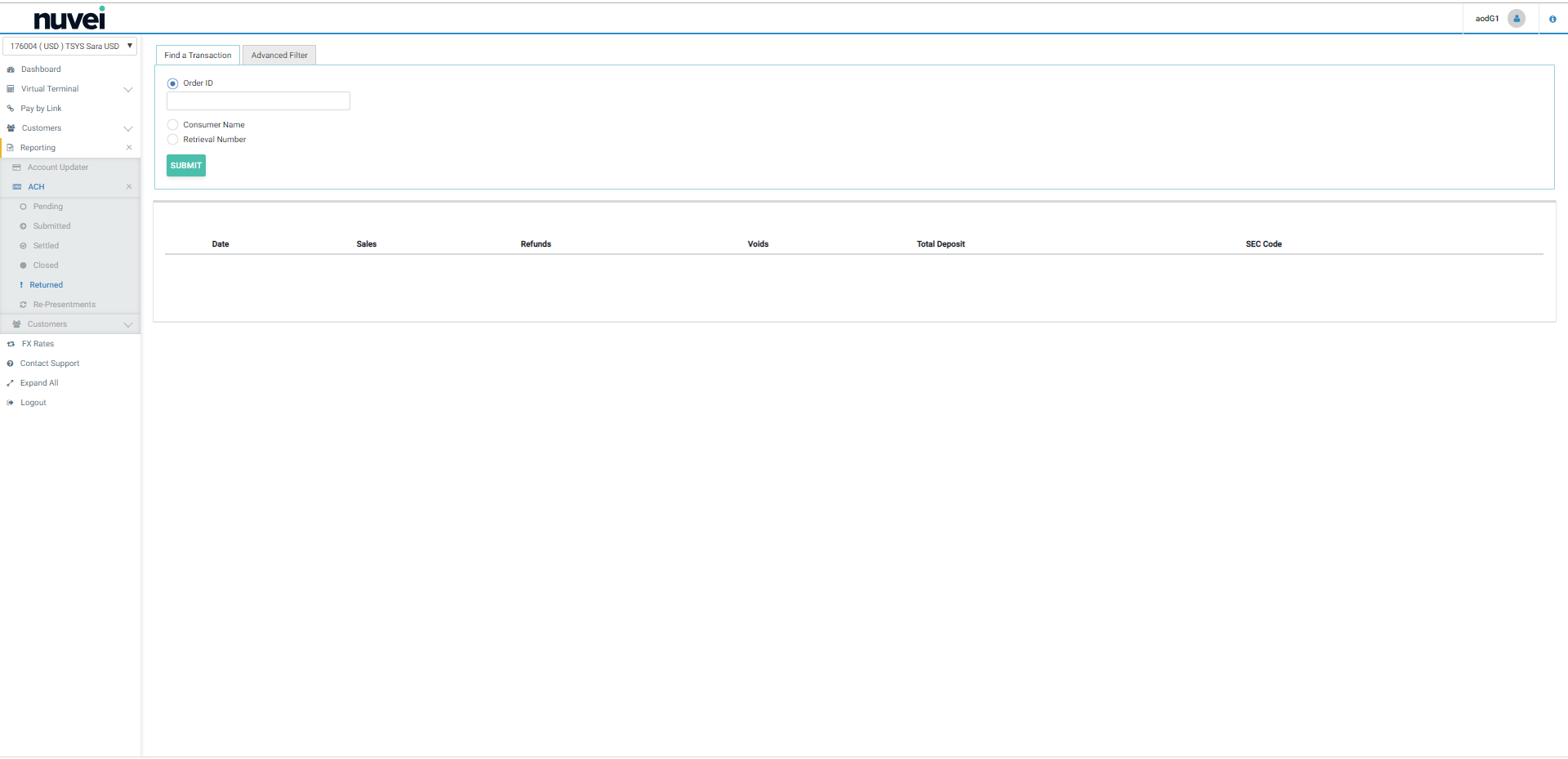

Returned Transactions

This report presents all the ACH returned transactions for the used terminal:

- I. Presenting two search options for transactions: simple and advanced - with filters.

- II. Grouped by Date.

- III. With a link (click on the date) to show the detailed list of transactions on that date.

- IV. Detailed in five summarizing lines for the transactions performed on that date:

- a) The first top line (aligned with the date) represents the sum of the remaining 4 lines (that's why its SEC Code column is always empty).

- b) Each of the four remaining lines represents the total volumes for transactions of each one of the Sec Codes - CCD, PPD, TEL and WEB (refer API Specification - ACH JH to know a little bit more about SEC Codes). Additionally, a link is also provided for each SEC Code to the list of transactions with that code on that date.

- c) Additionally, each line also groups the transactions as Sales, Refunds and Voids by quantity, represented by the value between “()”, followed by its total resulting amount. The Total Deposit totalizes those three types (Sales - Refunds - Voids).

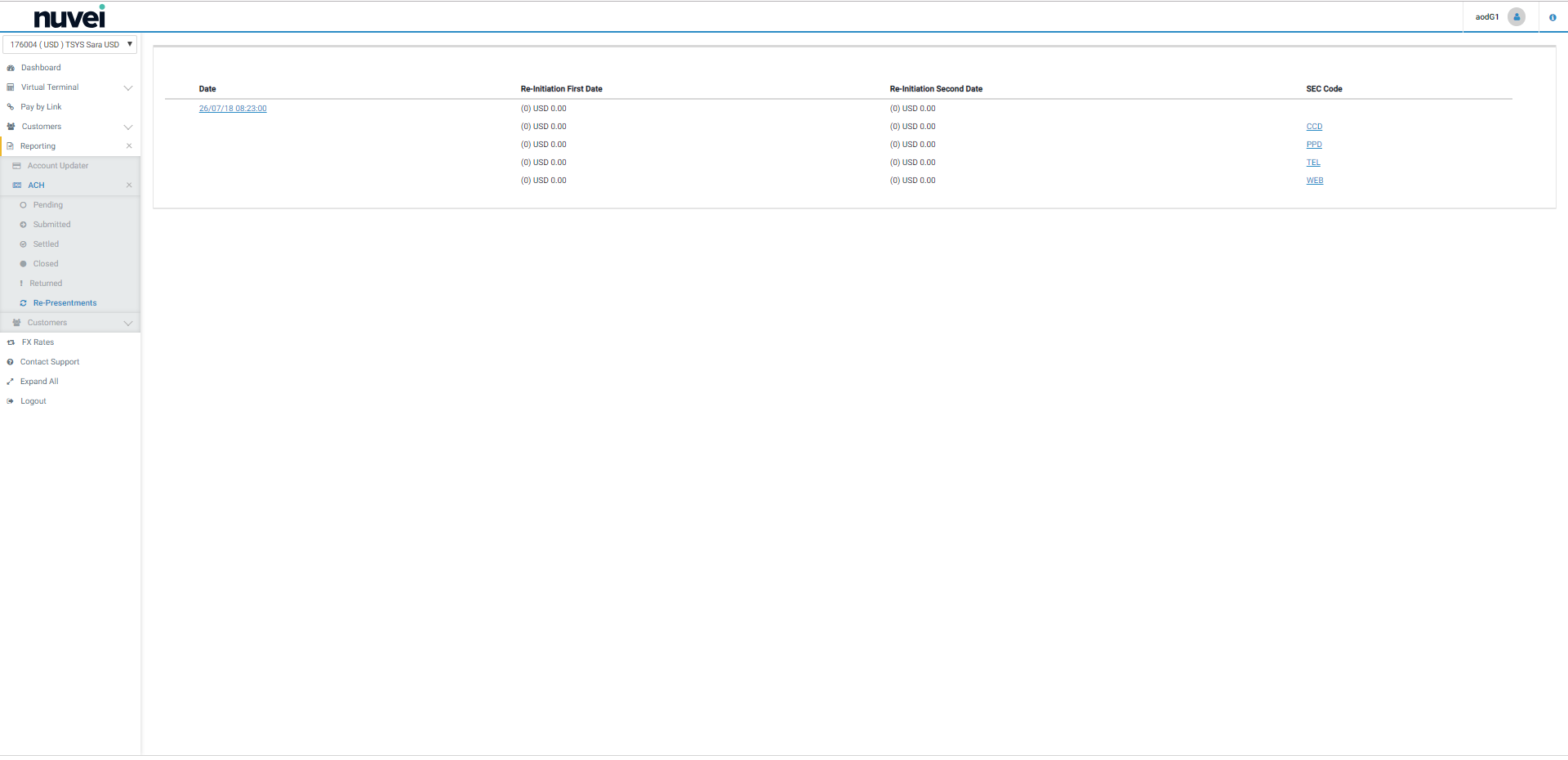

Transactions' Re-presentations

This report presents all the ACH re-presentrations of returned transactions for the used terminal:

- I. Grouped by Date.

- II. With a link (click on the date) to show the detailed list of transactions on that date.

- III. Detailed in five summarizing lines for the transactions performed on that date:

- a) The first top line (aligned with the date) represents the sum of the remaining 4 lines (that's why its SEC Code column is always empty).

- b) Each of the four remaining lines represents the total volumes for transactions of each one of the Sec Codes - CCD, PPD, TEL and WEB (refer API Specification - ACH JH to know a little bit more about SEC Codes). Additionally, a link is also provided for each SEC Code to the list of transactions with that code on that date.

- c) Additionally, each line also groups the transactions as Re-initiation First Date and Re-initiation Second Date by quantity, represented by the value between “()”, followed by its total resulting amount.

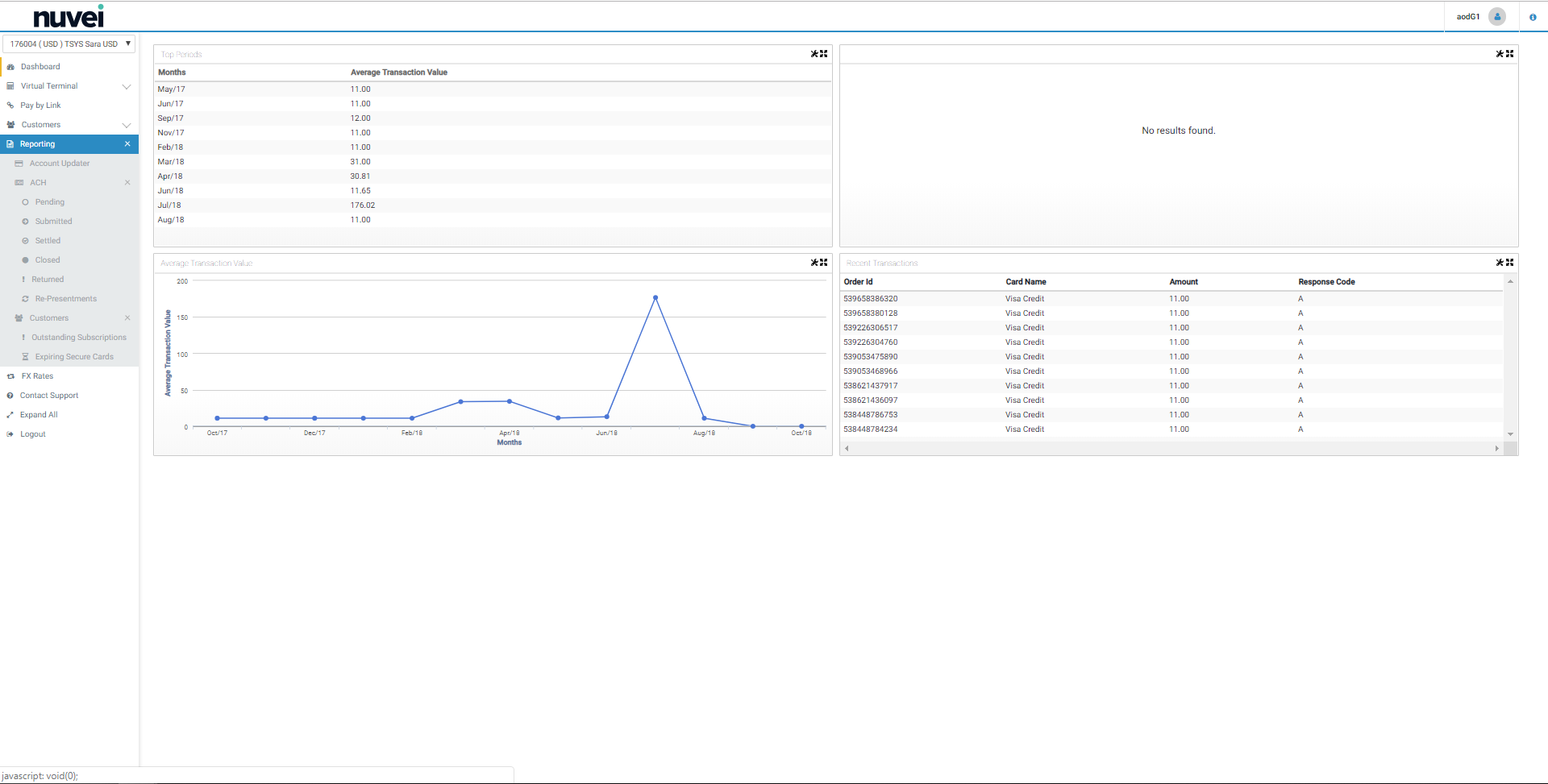

Customers

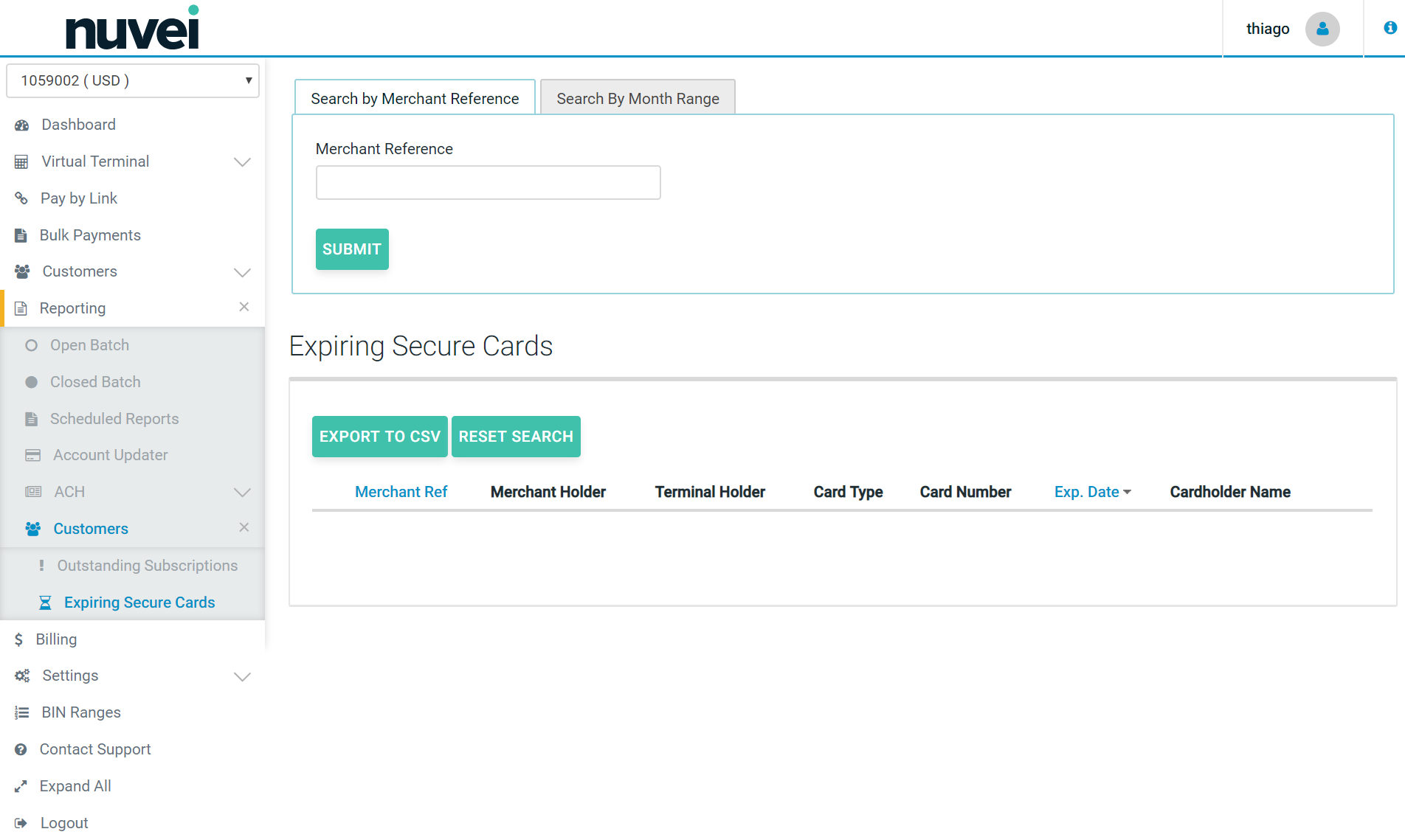

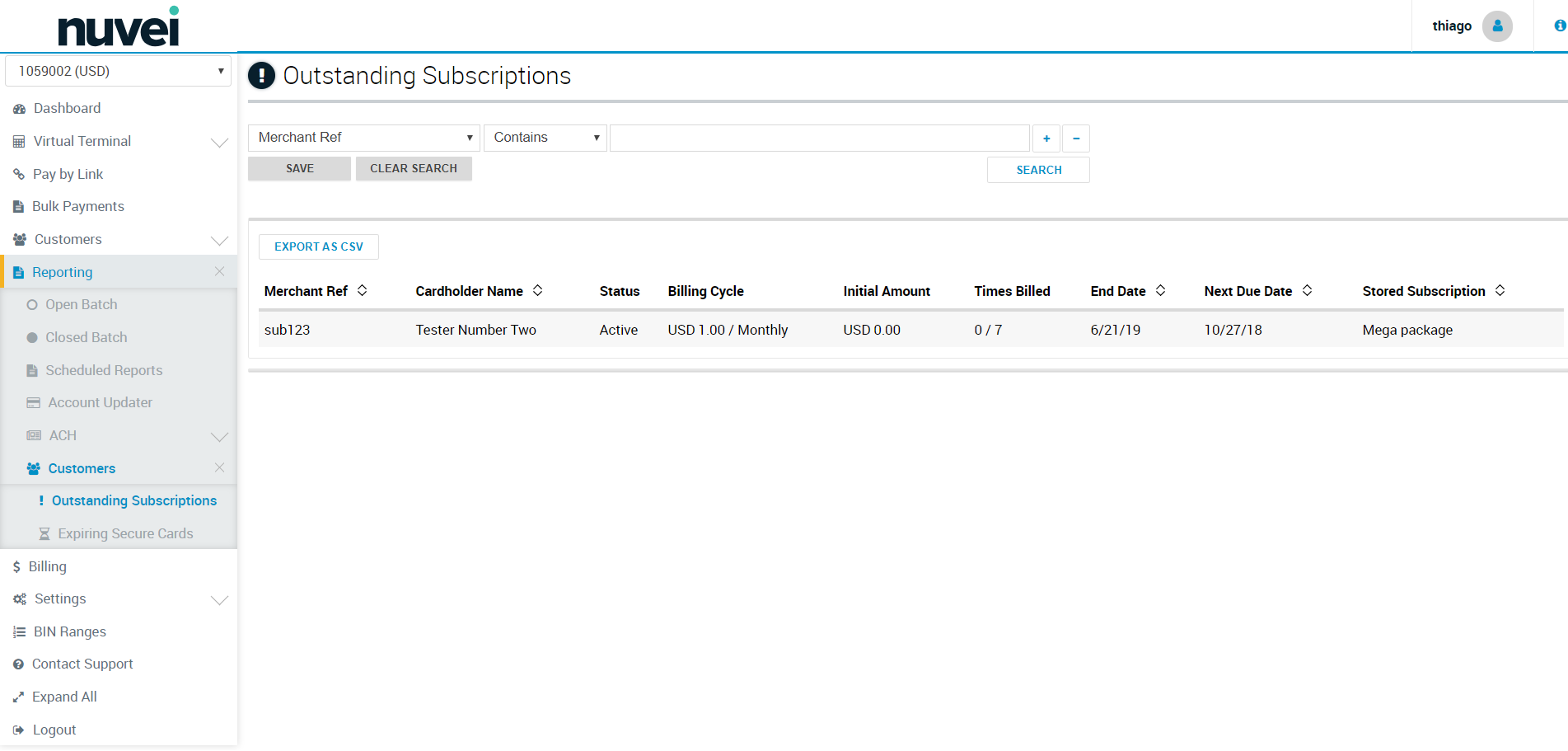

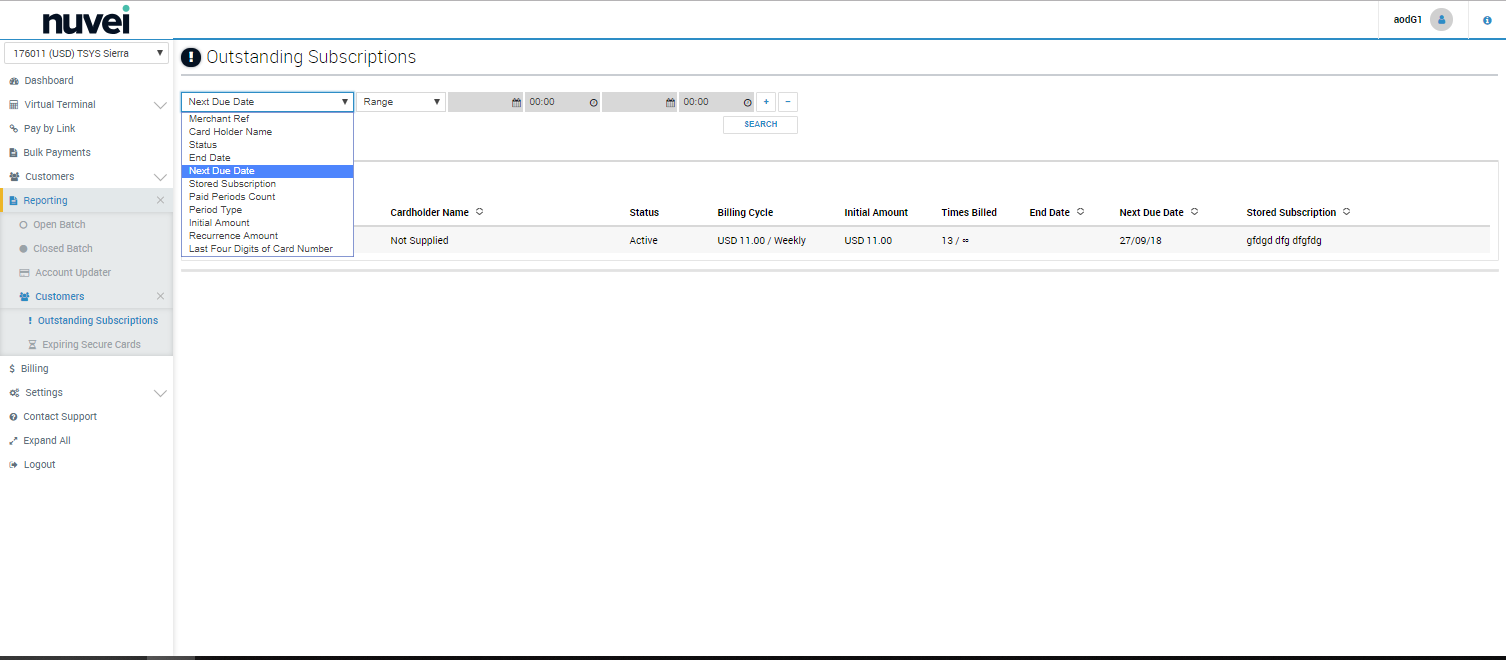

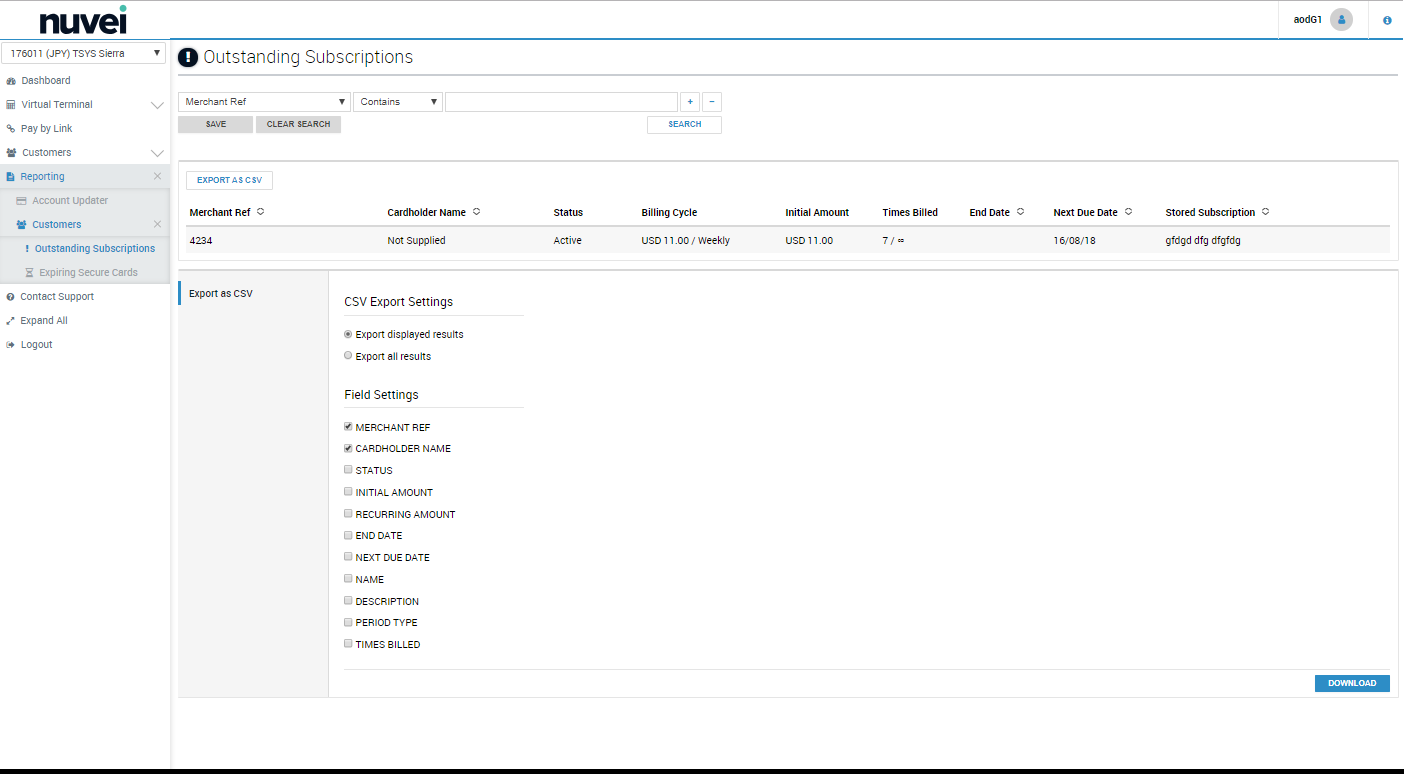

The “Customers” section under the Reporting tab enables merchants to view and manage “Outstanding Subscriptions with Payment Due” and “Expiring Secure Cards”.

The “Subscription” option shows all the details related to outstanding subscriptions.

It also provides the option to filter and search those subcriptions and export the details on this report to CSV.

The “Expiring Secure Cards” shows only the secure cards which are going to expire within the 2 months. This section includes the following details: Card type, Merchant Ref, Card Number, Cardholder Name and Expiry Date. You can search for expiring secure cards by “Merchant Reference” or by “Month Range” for up to 12 months.

It is possible also to export the details to CSV, if needed.